Estate Tax Rates, Exclusions, and Impact on Gift and Inheritance Taxes

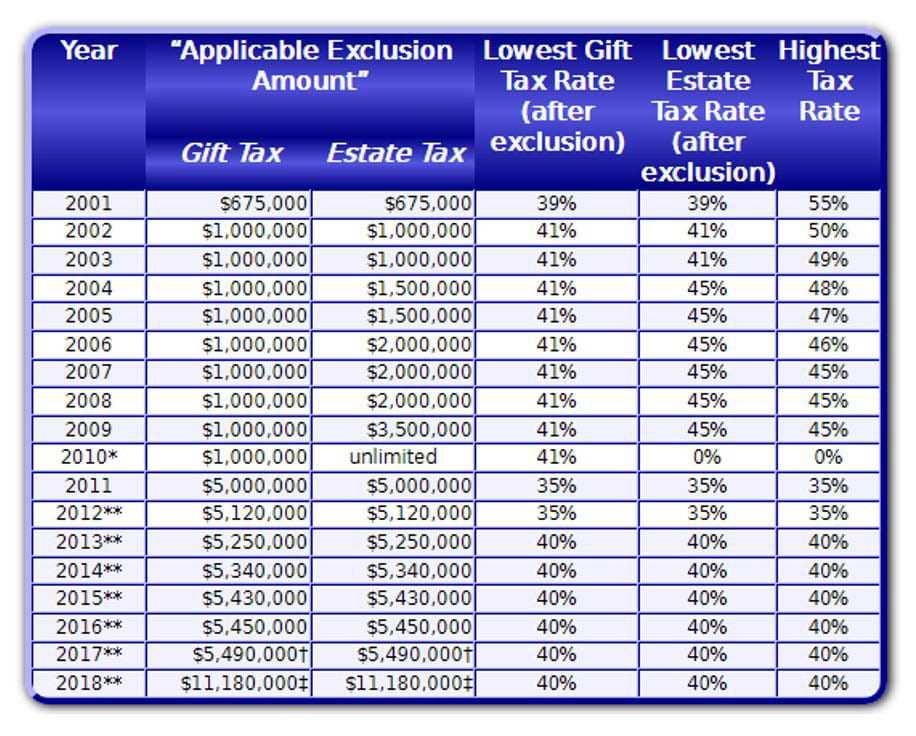

Overview of Estate Tax Rates Estate tax rates refer to the percentage of tax that is imposed on the value of an individual’s estate upon their death. These rates can vary depending on the total value of the estate and the applicable tax laws in the jurisdiction. Additionally, many jurisdictions … …