Cash Budget: Definition, Parts, and How to Create One

A cash budget is a financial tool used by businesses to forecast and manage their cash flow. It helps businesses plan and allocate their cash resources effectively, ensuring they have enough cash on hand to meet their financial obligations and make strategic investments.

Definition

A cash budget is a detailed plan that outlines a business’s expected cash inflows and outflows over a specific period of time, typically a month, quarter, or year. It takes into account various sources of cash inflows, such as sales revenue, loans, and investments, as well as cash outflows, such as operating expenses, loan repayments, and capital expenditures.

Parts of a Cash Budget

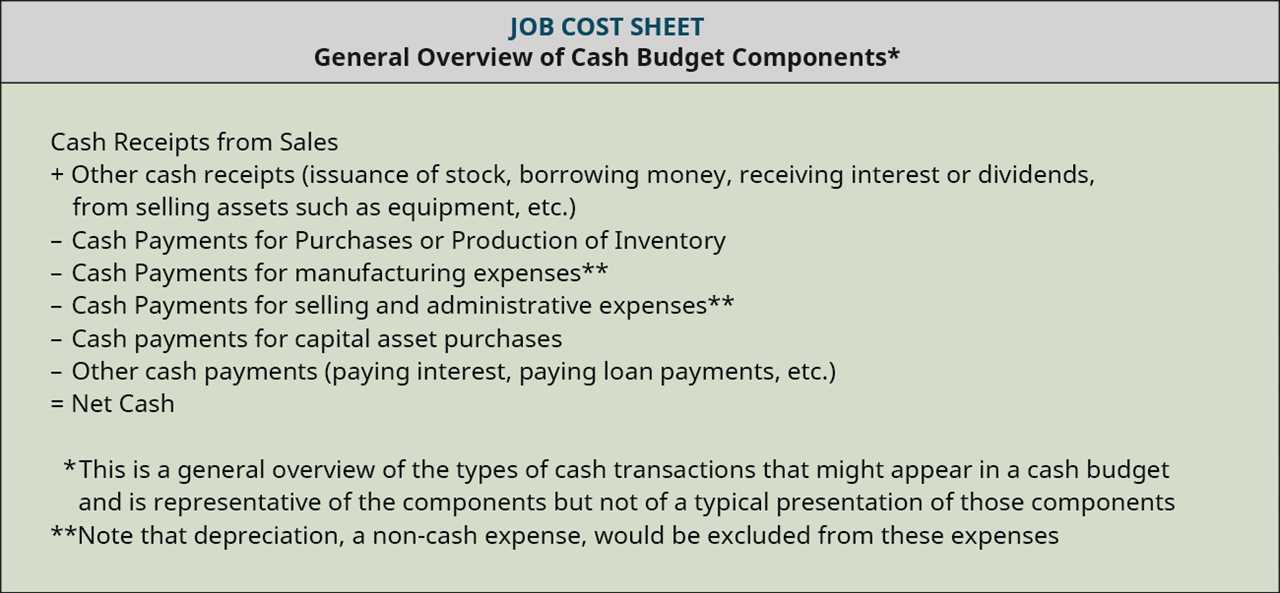

A cash budget typically consists of the following parts:

- Beginning Cash Balance: This is the amount of cash the business has at the start of the budget period.

- Cash Inflows: This includes all the sources of cash that the business expects to receive during the budget period, such as sales revenue, loans, and investments.

- Cash Outflows: This includes all the cash payments the business expects to make during the budget period, such as operating expenses, loan repayments, and capital expenditures.

- Net Cash Flow: This is the difference between the cash inflows and outflows. A positive net cash flow indicates that the business is generating more cash than it is spending, while a negative net cash flow indicates a cash deficit.

- Ending Cash Balance: This is the projected cash balance at the end of the budget period, calculated by adding the beginning cash balance and the net cash flow.

How to Create a Cash Budget

Creating a cash budget involves several steps:

- Collect Data: Gather all the necessary financial information, such as sales forecasts, expense estimates, loan repayment schedules, and capital expenditure plans.

- Estimate Cash Inflows: Determine the expected cash inflows from various sources, considering factors such as sales volume, credit terms, and payment patterns.

- Forecast Cash Outflows: Estimate the cash outflows based on the business’s operating expenses, loan obligations, and planned investments.

- Calculate Net Cash Flow: Calculate the net cash flow by subtracting the cash outflows from the cash inflows.

- Adjust and Review: Analyze the cash budget for any discrepancies or areas of concern, and make necessary adjustments to ensure a realistic and achievable plan.

By regularly monitoring and updating the cash budget, businesses can gain better control over their cash flow, make informed financial decisions, and avoid cash shortages or excesses. It serves as a valuable tool for financial planning and helps businesses maintain their financial stability and liquidity.

Importance of Cash Budget

The cash budget serves several important purposes for businesses:

- Forecasting: The cash budget allows businesses to forecast their future cash position based on projected sales, expenses, and other cash inflows and outflows. This helps in identifying potential cash shortages or surpluses and enables businesses to take proactive measures to address them.

- Planning: By analyzing the cash budget, businesses can plan their expenditures, investments, and financing activities. They can determine the optimal timing for making purchases, paying bills, and borrowing or repaying loans.

- Monitoring: The cash budget provides a benchmark against which businesses can monitor their actual cash inflows and outflows. This allows them to identify any deviations from the budgeted amounts and take corrective actions if necessary.

- Decision-making: The cash budget provides valuable information for decision-making. It helps businesses evaluate the financial feasibility of new projects, assess the impact of changes in sales or expenses, and determine the need for external financing.

Components of a Cash Budget

A typical cash budget consists of the following components:

- Cash Inflows: This includes all the sources of cash for the business, such as sales revenue, loans, investments, and any other income.

- Cash Outflows: This includes all the cash payments made by the business, such as expenses, salaries, loan repayments, taxes, and any other cash outflows.

- Beginning Cash Balance: This is the cash balance at the beginning of the budget period, which is carried forward from the previous period.

- Ending Cash Balance: This is the projected cash balance at the end of the budget period, which is calculated by subtracting the cash outflows from the cash inflows and adding it to the beginning cash balance.

Components of a Cash Budget

A cash budget is an important tool for businesses to manage their cash flow effectively. It helps in planning and controlling the inflows and outflows of cash, which is crucial for the financial stability of a company. A cash budget consists of various components that provide a comprehensive overview of the cash position of a business.

1. Sales Forecast

The sales forecast is the first component of a cash budget. It involves estimating the expected sales revenue for a specific period, usually on a monthly basis. The accuracy of the sales forecast is essential as it forms the basis for other components of the cash budget. Factors such as market trends, historical data, and industry analysis are considered while preparing the sales forecast.

2. Cash Receipts

Cash receipts refer to the inflow of cash into the business. This component includes all the sources of cash, such as cash sales, accounts receivable collections, loans, and investments. It is important to accurately estimate the timing and amount of cash receipts to ensure that there is sufficient cash to meet the company’s obligations.

3. Cash Disbursements

Cash disbursements represent the outflow of cash from the business. This component includes all the expenses and payments that need to be made, such as rent, utilities, salaries, raw materials, and loan repayments. It is crucial to accurately estimate the timing and amount of cash disbursements to avoid any cash shortages or overages.

4. Opening and Closing Cash Balances

The opening cash balance is the amount of cash available at the beginning of the budget period, while the closing cash balance is the projected cash balance at the end of the period. These balances are determined by taking into account the cash receipts, cash disbursements, and any other cash inflows or outflows during the period. The opening and closing cash balances help in assessing the liquidity and financial health of the business.

5. Cash Surplus or Deficit

The cash surplus or deficit is the difference between the total cash receipts and total cash disbursements for a specific period. A cash surplus indicates that the business has more cash inflows than outflows, while a cash deficit indicates the opposite. It is important to analyze the cash surplus or deficit to make informed decisions regarding investments, borrowing, or cost-cutting measures.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.