Bullish Engulfing Pattern: Definition and Example

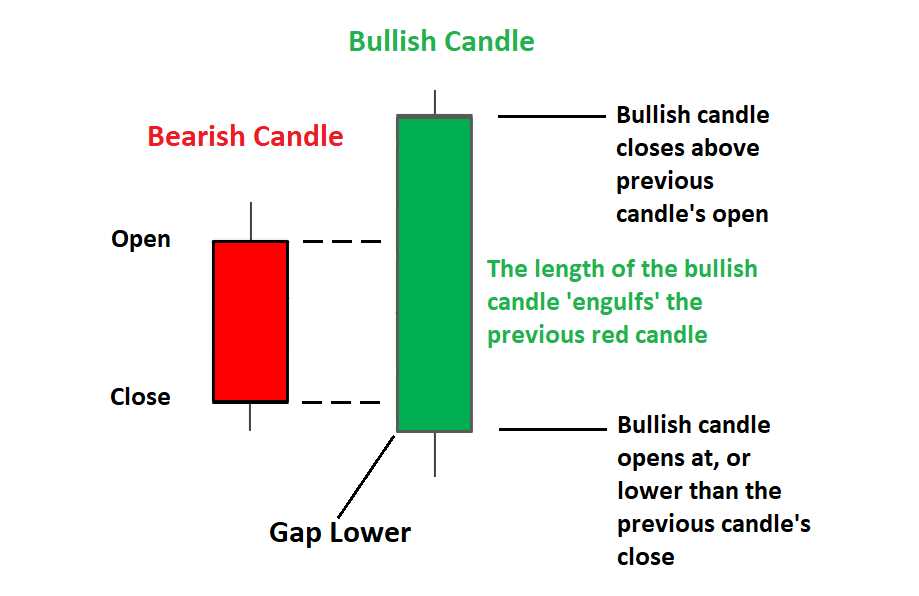

A bullish engulfing pattern is a candlestick pattern that is formed when a small bearish candle is followed by a larger bullish candle. The bullish candle completely engulfs the previous bearish candle, indicating a potential reversal in the price trend.

To identify a bullish engulfing pattern, look for the following criteria:

- The first candle should be a small bearish candle, indicating a temporary price decline.

- The second candle should be a larger bullish candle, completely engulfing the previous bearish candle.

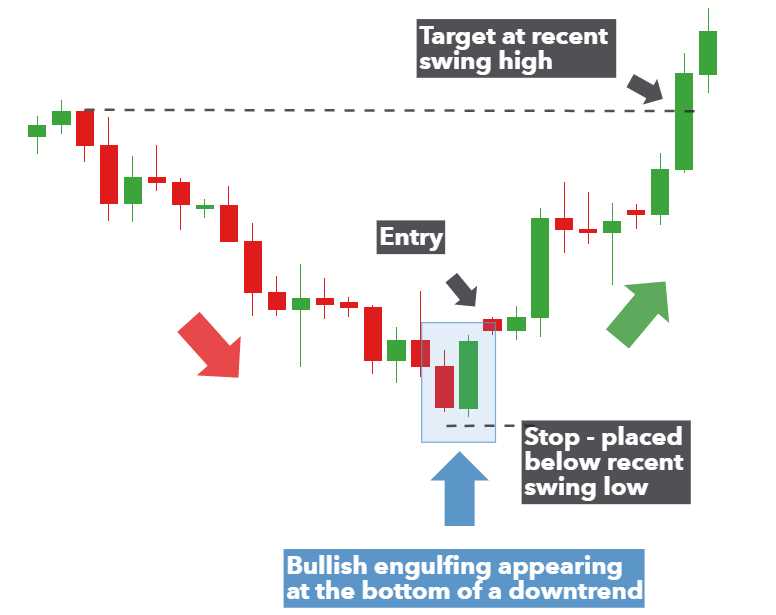

- The pattern should occur after a downtrend, indicating a potential reversal in the price trend.

The bullish engulfing pattern is considered a strong bullish signal, as it shows that buyers have taken control and are pushing the price higher. It suggests that the previous selling pressure has been overcome and that a bullish trend may be starting.

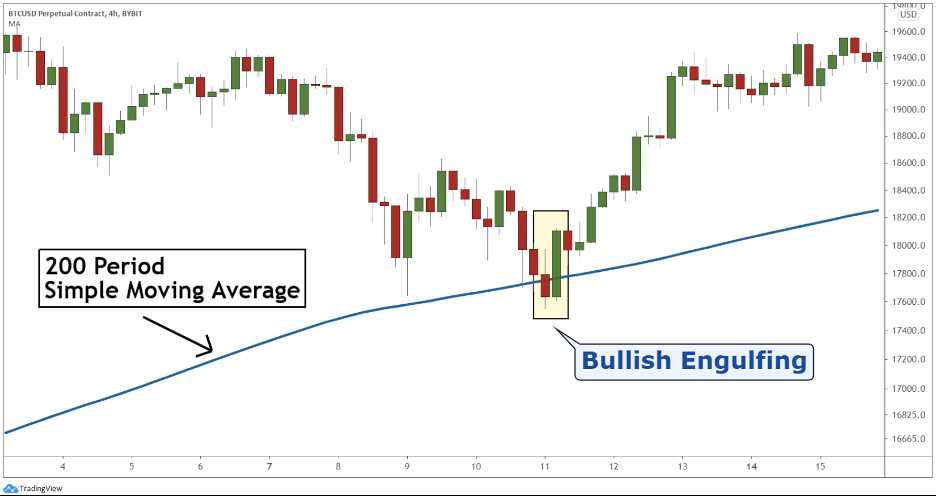

Traders often look for confirmation of the bullish engulfing pattern by analyzing other technical indicators or chart patterns. For example, they may look for an increase in trading volume or the presence of other bullish signals.

Here is an example of a bullish engulfing pattern:

Step 1: The price is in a downtrend, with a small bearish candle indicating a temporary price decline.

Step 2: A larger bullish candle forms, completely engulfing the previous bearish candle.

Step 3: The pattern suggests a potential reversal in the price trend, with buyers taking control and pushing the price higher.

Overall, the bullish engulfing pattern is a popular candlestick pattern among technical analysts. It can provide valuable insights into potential reversals in the price trend and help traders make informed trading decisions.

What is a Bullish Engulfing Pattern?

A bullish engulfing pattern is a popular candlestick pattern used in technical analysis to predict a potential reversal in a downtrend. It is formed when a small bearish candlestick is followed by a larger bullish candlestick that completely engulfs the previous candlestick.

The bullish engulfing pattern is considered a strong bullish signal because it indicates that buyers have overwhelmed sellers and are likely to push the price higher. The pattern suggests a shift in sentiment from bearish to bullish, and traders often interpret it as a sign of a potential trend reversal.

Characteristics of a Bullish Engulfing Pattern

To identify a bullish engulfing pattern, traders look for the following characteristics:

- A small bearish candlestick that represents a price decline.

- A larger bullish candlestick that completely engulfs the previous candlestick.

- The bullish candlestick opens below the previous candlestick’s close and closes above its open.

Example of a Bullish Engulfing Pattern

Let’s take a look at an example to better understand how a bullish engulfing pattern works:

On a daily chart of a stock, you notice a small bearish candlestick followed by a larger bullish candlestick. The bullish candlestick opens below the previous candlestick’s close and closes above its open, completely engulfing the bearish candlestick. This pattern indicates a potential reversal in the downtrend and suggests that buyers are gaining control.

Traders who recognize this pattern may interpret it as a signal to enter a long position or to close out their short positions, anticipating a price increase in the near future.

Example of a Bullish Engulfing Pattern

A bullish engulfing pattern is a powerful candlestick pattern that often signals a reversal in a downtrend. It occurs when a small bearish candle is followed by a larger bullish candle that completely engulfs the previous candle.

Let’s take a look at an example to better understand how a bullish engulfing pattern works:

Step 1: Downtrend

Step 2: Small Bearish Candle

Next, we look for a small bearish candle, which represents a temporary pause or pullback in the downtrend. This candle should have a smaller body and a longer upper shadow.

Step 3: Bullish Engulfing Candle

The key element of a bullish engulfing pattern is the larger bullish candle that follows the small bearish candle. This candle should have a larger body and completely engulf the previous candle, including its body and shadows.

Step 4: Confirmation

To confirm the bullish engulfing pattern, we can look for additional signs of bullishness, such as an increase in trading volume or the presence of other bullish indicators.

Once the bullish engulfing pattern is confirmed, it suggests that the bears are losing control and the bulls are taking over. Traders may interpret this as a signal to enter a long position or to close out their short positions.

What It Means in Technical Analysis

The Bullish Engulfing Pattern is a significant candlestick pattern in technical analysis that indicates a potential reversal of a downtrend. It is formed when a small bearish candlestick is followed by a larger bullish candlestick that completely engulfs the previous candlestick, including its body and shadows.

This pattern suggests that buyers have taken control of the market and are overpowering the sellers. It is considered a bullish signal because it shows a shift in market sentiment from bearish to bullish. Traders often interpret this pattern as a sign of a potential trend reversal and an opportunity to enter long positions.

When the Bullish Engulfing Pattern occurs after a prolonged downtrend, it is seen as a stronger signal of a trend reversal. It indicates that the selling pressure has been exhausted, and buyers are stepping in to drive the price higher. Traders may use this pattern as a confirmation to enter long positions or to close out their short positions.

However, it is important to note that the Bullish Engulfing Pattern should not be used in isolation. It is recommended to consider other technical indicators and analysis tools to confirm the validity of the pattern and to make informed trading decisions.

Some traders also use the Bullish Engulfing Pattern as a signal to place stop-loss orders. They may set their stop-loss below the low of the engulfing candlestick to protect their positions in case the pattern fails and the price reverses.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.