Automatic Bill Payment: Simplify Your Finances

Managing bills and keeping track of due dates can be a daunting task. With the numerous bills that need to be paid each month, it’s easy to forget or miss a payment, which can result in late fees and negative impacts on your credit score. However, with automatic bill payment, you can simplify your finances and ensure that your bills are paid on time.

What is Automatic Bill Payment?

Automatic bill payment is a convenient service offered by many banks and financial institutions. It allows you to set up recurring payments for your bills, such as utilities, rent, mortgage, and credit card payments. Once you have set up automatic bill payment, the specified amount will be automatically deducted from your bank account on the due date.

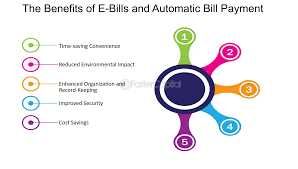

The Benefits of Automatic Bill Payment

There are several benefits to using automatic bill payment:

| 1. Convenience | Automatic bill payment eliminates the need to manually pay your bills each month. You don’t have to worry about remembering due dates or writing checks. The payments are made automatically, saving you time and effort. |

| 2. Avoid Late Fees | By setting up automatic bill payment, you can ensure that your bills are paid on time. This helps you avoid late fees, which can add up over time and affect your monthly budget. |

| 3. Improve Credit Score | Consistently paying your bills on time is crucial for maintaining a good credit score. With automatic bill payment, you can avoid late payments and improve your creditworthiness. |

| 4. Peace of Mind | Knowing that your bills are being paid automatically gives you peace of mind. You don’t have to worry about missing a payment or dealing with the consequences of late payments. |

Overall, automatic bill payment is a convenient and reliable way to simplify your finances. It helps you stay organized, avoid late fees, improve your credit score, and provides peace of mind. Consider setting up automatic bill payment to streamline your bill-paying process and take control of your financial obligations.

Why You Should Consider Automatic Bill Payment

Paying bills can be a tedious and time-consuming task. It often involves remembering due dates, writing checks, and mailing them out. However, with automatic bill payment, you can simplify your financial life and save yourself the hassle of manual bill payments.

Convenience

One of the main reasons to consider automatic bill payment is the convenience it offers. Once you set up automatic payments, your bills will be paid automatically on their due dates without any effort on your part. This means no more late fees or missed payments due to forgetfulness or busy schedules. You can relax knowing that your bills will be taken care of automatically.

Time-saving

Automatic bill payment can save you a significant amount of time. Instead of spending time writing checks, addressing envelopes, and going to the post office, you can use that time for more important things in your life. Whether it’s spending quality time with your family, pursuing hobbies, or focusing on your career, automatic bill payment allows you to free up time and simplify your financial routine.

Financial Organization

Automatic bill payment can also help you stay organized financially. By setting up automatic payments, you can track your expenses more easily and have a clear overview of your monthly bills. This can be especially helpful for budgeting purposes, as you can see exactly how much money is going towards various bills each month. It can also help you avoid overspending or forgetting to pay certain bills.

Peace of Mind

With automatic bill payment, you can have peace of mind knowing that your bills will be paid on time. You won’t have to worry about missing due dates or incurring late fees. This can reduce stress and anxiety related to bill payments and allow you to focus on other aspects of your life.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.