Asset Retirement Obligation Definition

An asset retirement obligation (ARO) is a legal obligation associated with the retirement of a long-lived asset. It refers to the costs that a company is expected to incur when it retires a tangible asset, such as a building, a piece of machinery, or an oil well.

When a company acquires or constructs an asset, it is often required by law or contract to eventually retire or dismantle that asset. The ARO represents the estimated future costs associated with the retirement of the asset, including the removal, disposal, and site restoration expenses.

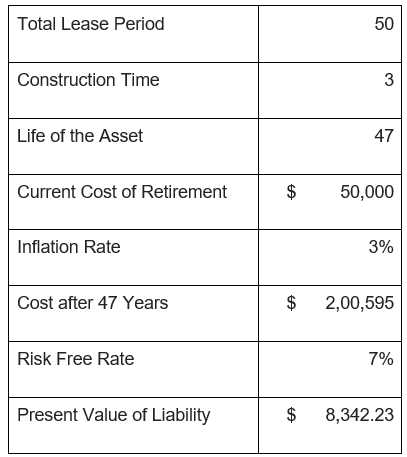

Companies are required to recognize the ARO as a liability on their balance sheets when they incur the obligation, typically at the time of asset acquisition or construction. The ARO liability is initially measured at its fair value, which is the present value of the estimated retirement costs.

The ARO liability is then accreted over time, using an appropriate discount rate, to reflect the increase in the liability’s present value as time passes. This accretion expense is recognized as an operating expense on the income statement.

When the retirement obligation is settled, the company recognizes a gain or loss on the difference between the actual costs incurred and the estimated costs initially recognized. This gain or loss is reported on the income statement.

It is important for companies to accurately estimate their AROs, as underestimating the costs can lead to financial difficulties down the line. Additionally, companies must regularly reassess their AROs and adjust them if necessary to reflect changes in estimates or regulations.

Overall, the asset retirement obligation is an important concept in accounting and financial reporting, as it ensures that companies properly account for the costs associated with retiring long-lived assets and provides transparency to investors and stakeholders.

What is Asset Retirement Obligation?

Asset Retirement Obligation (ARO) refers to the legal or contractual obligation that a company has to retire a long-lived asset at the end of its useful life. This obligation arises when a company acquires or constructs an asset that will require future costs for decommissioning, dismantling, or removing the asset.

ARO is typically associated with industries such as oil and gas, mining, power generation, and manufacturing, where companies have significant long-term assets that will eventually need to be retired. These assets can include oil rigs, power plants, mines, and manufacturing facilities.

How is Asset Retirement Obligation recognized?

Under accounting standards, companies are required to recognize the fair value of their ARO as a liability on their balance sheet. The fair value is determined by estimating the present value of the expected future costs associated with retiring the asset.

Examples of Asset Retirement Obligation

Here are a few examples of ARO:

- An oil company has an ARO for the decommissioning of an offshore oil rig at the end of its useful life.

- A mining company has an ARO for the reclamation of a mine site once mining operations cease.

- A power generation company has an ARO for the dismantling and removal of a nuclear power plant.

- A manufacturing company has an ARO for the removal and disposal of hazardous materials used in its production process.

These examples illustrate the diverse nature of ARO and the different types of assets and industries that can be subject to this obligation.

Overall, Asset Retirement Obligation is an important concept in accounting as it ensures that companies properly account for the costs associated with retiring long-lived assets and helps provide transparency to investors and stakeholders.

Asset Retirement Obligation Examples

Asset retirement obligation (ARO) refers to the legal or contractual obligation that an entity has to retire a long-lived asset. This obligation arises when an entity acquires or constructs an asset that will require future retirement, such as decommissioning, dismantling, or environmental cleanup.

Here are some examples of asset retirement obligations:

1. Oil and Gas Industry

In the oil and gas industry, companies often have asset retirement obligations related to the decommissioning of oil rigs and wells. When an oil rig reaches the end of its useful life, the company is responsible for dismantling and removing the rig, as well as restoring the site to its original condition. This can involve significant costs and environmental considerations.

2. Power Generation

Power generation companies, such as those operating nuclear power plants, have asset retirement obligations associated with the decommissioning of their facilities. When a nuclear power plant reaches the end of its operating life, the company is responsible for safely shutting down the plant, removing radioactive materials, and decontaminating the site. This process can take several years and involves strict regulatory requirements.

3. Mining Industry

In the mining industry, companies often have asset retirement obligations related to the reclamation of mining sites. After a mine has been exhausted or closed, the company is responsible for restoring the site to its pre-mining condition. This may include filling in open pits, regrading the land, and replanting vegetation. The cost of reclamation can be significant, especially for large-scale mining operations.

4. Environmental Remediation

Companies that have caused environmental damage or pollution may have asset retirement obligations related to the cleanup and remediation of the affected areas. This can include removing hazardous materials, restoring contaminated soil and water, and implementing long-term monitoring and maintenance plans. The cost of environmental remediation can vary widely depending on the extent of the damage and the required cleanup measures.

Overall, asset retirement obligations are an important consideration for companies in industries that involve long-lived assets with future retirement requirements. These obligations can have significant financial and environmental implications, and companies must carefully account for them in their financial statements and planning processes.

Examples of Asset Retirement Obligation

Asset retirement obligation (ARO) is a legal requirement for companies to set aside funds for the future decommissioning or retirement of certain assets. Here are some examples of asset retirement obligations:

| Industry | Asset | Estimated Retirement Cost |

|---|---|---|

| Oil and Gas | Offshore Oil Rig | $10 million |

| Power Generation | Nuclear Power Plant | $100 million |

| Chemical Manufacturing | Chemical Storage Tanks | $5 million |

| Mining | Open Pit Mine | $50 million |

These examples illustrate the diverse range of assets and industries that may have asset retirement obligations. In the oil and gas industry, offshore oil rigs require significant funds for decommissioning and removal once they reach the end of their operational life. Similarly, nuclear power plants have extensive retirement costs due to the complex and hazardous nature of their decommissioning process.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.