Aroon Oscillator: Definition, Calculation, and Trade Signals

The Aroon Oscillator is calculated by subtracting the Aroon Down line from the Aroon Up line. The Aroon Up line measures the number of periods since the highest price within a given time frame, while the Aroon Down line measures the number of periods since the lowest price within the same time frame.

The Aroon Oscillator can take values ranging from -100 to +100. A positive value indicates that the uptrend is gaining strength, while a negative value indicates that the downtrend is gaining strength. A value close to zero suggests that there is no clear trend in the market.

Traders use the Aroon Oscillator to generate trade signals. When the oscillator crosses above the zero line, it is considered a bullish signal, indicating that the uptrend is strengthening. Conversely, when the oscillator crosses below the zero line, it is considered a bearish signal, indicating that the downtrend is strengthening.

It is important to note that the Aroon Oscillator is a lagging indicator, meaning that it may not provide timely signals during periods of rapid price movements. Therefore, it is often used in conjunction with other technical analysis tools to confirm trade signals.

What is the Aroon Oscillator?

The Aroon Up line measures the number of periods since the highest high within a given time period, while the Aroon Down line measures the number of periods since the lowest low within the same time period. The Aroon Oscillator is then calculated by subtracting the Aroon Down line from the Aroon Up line.

The Aroon Oscillator fluctuates between -100 and +100, with positive values indicating an uptrend and negative values indicating a downtrend. A reading of 0 indicates a balanced market with no clear trend.

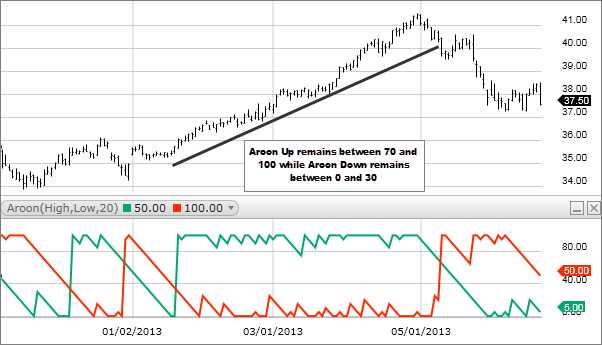

Traders and investors use the Aroon Oscillator to identify potential trend reversals and to confirm the strength of a trend. When the Aroon Oscillator crosses above zero, it is considered a bullish signal, indicating that the uptrend is gaining strength. Conversely, when the Aroon Oscillator crosses below zero, it is considered a bearish signal, indicating that the downtrend is gaining strength.

It is important to note that the Aroon Oscillator is a lagging indicator, meaning that it may not provide timely signals in rapidly changing market conditions. Therefore, it is often used in conjunction with other technical indicators and analysis tools to confirm trading decisions.

How is the Aroon Oscillator Calculated?

The Aroon Oscillator is calculated by subtracting the Aroon Down value from the Aroon Up value. The Aroon Up value measures the number of periods since the highest high within a given time period, while the Aroon Down value measures the number of periods since the lowest low within the same time period.

To calculate the Aroon Up value, the highest high within the time period is identified, and the number of periods since that high is calculated. This value is then divided by the time period and multiplied by 100 to get a percentage. The formula for Aroon Up is:

Similarly, to calculate the Aroon Down value, the lowest low within the time period is identified, and the number of periods since that low is calculated. This value is also divided by the time period and multiplied by 100 to get a percentage. The formula for Aroon Down is:

Once the Aroon Up and Aroon Down values are calculated, the Aroon Oscillator is obtained by subtracting the Aroon Down value from the Aroon Up value. The formula for the Aroon Oscillator is:

The Aroon Oscillator can take values between -100 and 100. A positive value indicates a bullish trend, while a negative value indicates a bearish trend. Traders can use the Aroon Oscillator to identify potential trend reversals and generate trade signals.

| Aroon Oscillator Value | Trend Interpretation |

|---|---|

| Positive value | Bullish trend |

| Negative value | Bearish trend |

| Value close to 0 | Indicates a weak trend |

Traders can use the Aroon Oscillator in conjunction with other technical analysis tools to confirm signals and make informed trading decisions. It is important to note that the Aroon Oscillator is not a standalone indicator and should be used in combination with other indicators and analysis techniques.

Trade Signals from the Aroon Oscillator

The Aroon Oscillator is a technical analysis tool that can provide valuable trade signals to traders and investors. It is derived from the Aroon Indicator, which measures the strength and direction of a trend. The Aroon Oscillator takes the difference between the Aroon Up and Aroon Down lines and plots it on a separate oscillator chart.

Traders can use the Aroon Oscillator to identify potential trend reversals and trade opportunities. Here are some common trade signals generated by the Aroon Oscillator:

1. Zero Line Crossover: When the Aroon Oscillator crosses above the zero line, it indicates that the uptrend is gaining strength and there may be a bullish trading opportunity. Conversely, when the oscillator crosses below the zero line, it suggests that the downtrend is strengthening and there may be a bearish trading opportunity.

2. Signal Line Crossover: Some traders use a signal line, such as a moving average, to filter out false signals. When the Aroon Oscillator crosses above the signal line, it generates a buy signal, indicating a potential uptrend. On the other hand, when the oscillator crosses below the signal line, it generates a sell signal, indicating a potential downtrend.

3. Overbought/Oversold Conditions: The Aroon Oscillator can also be used to identify overbought and oversold conditions in the market. When the oscillator reaches extreme levels, such as above +70 or below -70, it suggests that the market may be overbought or oversold, respectively. Traders can use this information to anticipate potential reversals or pullbacks.

4. Divergence: Divergence occurs when the price of an asset and the Aroon Oscillator move in opposite directions. For example, if the price is making higher highs while the oscillator is making lower highs, it indicates a potential trend reversal. Traders can use divergence as a signal to enter or exit trades.

5. Confirmation with Other Indicators: The Aroon Oscillator can be used in conjunction with other technical indicators to confirm trade signals. For example, if the oscillator generates a buy signal and is supported by bullish candlestick patterns or positive momentum indicators, it strengthens the probability of a successful trade.

It is important to note that the Aroon Oscillator is just one tool among many in a trader’s toolkit. It should be used in conjunction with other technical analysis tools and risk management strategies to make informed trading decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.