What is Activity-Based Costing Method?

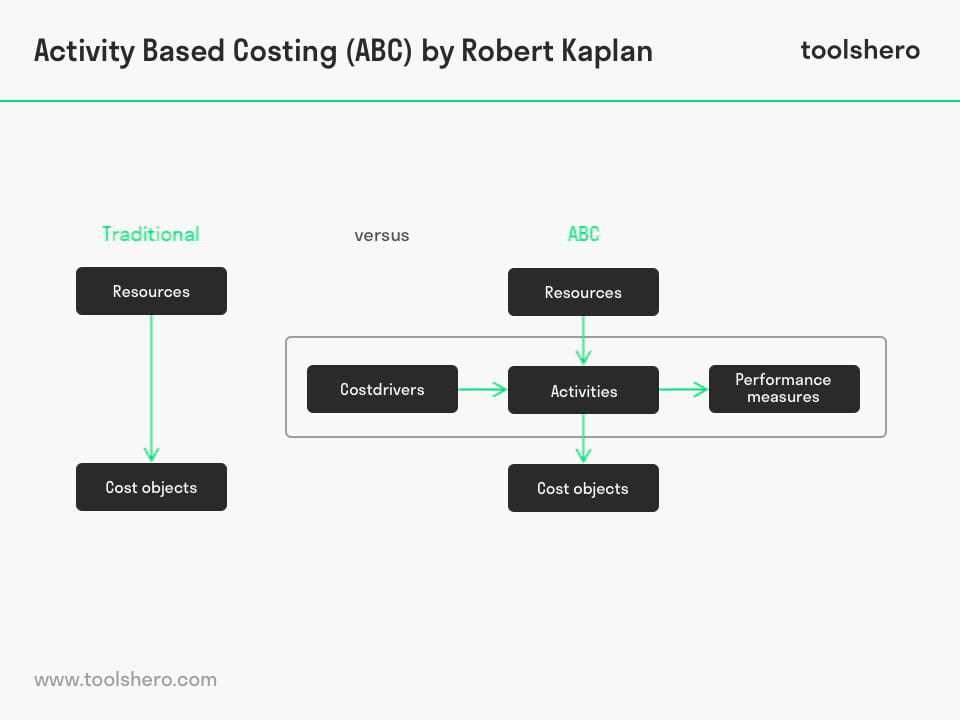

Activity-Based Costing (ABC) is a costing method that identifies and assigns costs to specific activities and then allocates those costs to products or services based on the activities they consume. It is a more accurate way of determining the true cost of a product or service compared to traditional costing methods.

ABC takes into account the fact that different products or services consume different activities and resources in the production process. It recognizes that not all costs are directly related to the volume of production, but rather to the activities required to produce the product or service.

By using ABC, companies can better understand the cost drivers of their products or services and make more informed decisions regarding pricing, product mix, and resource allocation. It provides a more comprehensive view of the costs involved in the production process and helps identify areas for cost reduction or improvement.

Overall, the Activity-Based Costing method provides a more accurate and detailed picture of the costs associated with producing a product or service, enabling companies to make better decisions and improve their cost management strategies.

Definition and Explanation

How does Activity-Based Costing work?

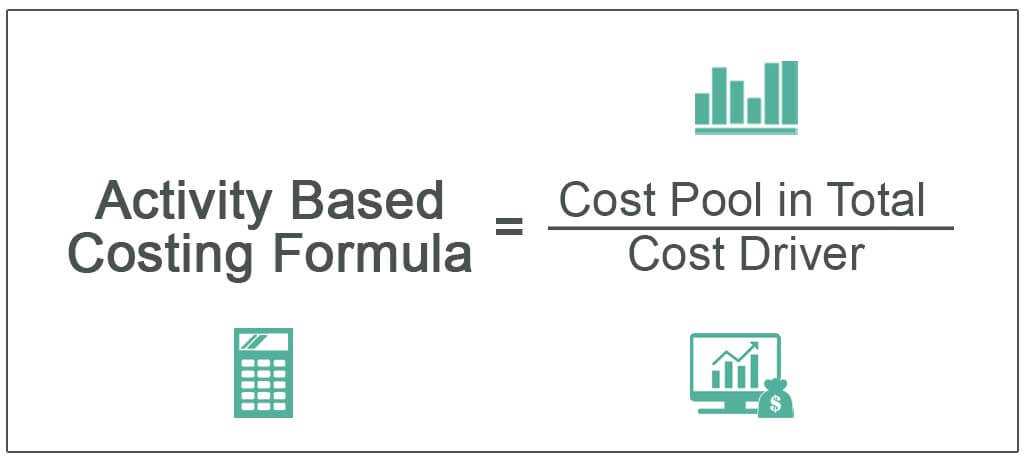

Activity-Based Costing works by identifying and categorizing activities into cost pools. These cost pools represent the different activities that are performed in a business, such as setup costs, inspection costs, or customer service costs.

Once the activities are identified, ABC assigns costs to each activity based on the resources consumed. This can include direct costs, such as labor or materials, as well as indirect costs, such as overhead expenses. The costs are allocated to the activities using cost drivers, which are factors that determine the consumption of resources.

After the costs are assigned to the activities, ABC allocates the costs to the products or services based on their usage of the activities. This provides a more accurate representation of the costs associated with each product or service, as it takes into account the specific activities required for their production.

Why is Activity-Based Costing important?

This accuracy in cost allocation can lead to better decision making, as managers can have a clearer picture of the costs associated with different products or services. It can also help in identifying areas where costs can be reduced or eliminated, leading to improved efficiency and profitability.

Advantages of Activity-Based Costing Method

The Activity-Based Costing (ABC) method offers several advantages over traditional costing methods. By providing a more accurate allocation of costs to products or services, ABC enables businesses to make better-informed decisions and improve overall cost management. Here are some key advantages of using the ABC method:

1. Enhanced Cost Accuracy

One of the primary advantages of ABC is its ability to provide a more accurate representation of the actual costs incurred by different activities within an organization. Traditional costing methods often rely on arbitrary allocation bases, such as direct labor hours or machine hours, which may not accurately reflect the true cost drivers.

2. Improved Decision Making

By providing a more accurate cost allocation, ABC enables businesses to make better-informed decisions. With traditional costing methods, certain products or services may appear more profitable than they actually are, leading to incorrect pricing decisions or resource allocation.

ABC helps businesses identify the true costs associated with each product or service, taking into account the specific activities and resources required. This allows for more accurate pricing strategies, better resource allocation, and improved profitability analysis.

Improved Cost Accuracy

One of the key advantages of using the Activity-Based Costing (ABC) method is that it leads to improved cost accuracy. Traditional costing methods often allocate overhead costs based on a single cost driver, such as direct labor hours or machine hours. However, this approach can result in inaccurate cost allocations, especially in complex and diverse production environments.

With ABC, costs are allocated based on the activities that consume resources, rather than relying solely on a single cost driver. This allows for a more accurate distribution of costs, as it takes into account the specific activities that contribute to the consumption of resources.

By accurately allocating costs to activities, ABC provides a clearer picture of the true cost of producing a product or providing a service. This information is valuable for decision-making purposes, as it allows managers to identify the most cost-effective ways to allocate resources and improve overall efficiency.

Furthermore, improved cost accuracy through ABC can also help in identifying and eliminating non-value-added activities, which are activities that do not directly contribute to the production or delivery of a product or service. By eliminating these activities, organizations can reduce costs and improve their competitiveness in the market.

Better Decision Making

One of the key advantages of the Activity-Based Costing (ABC) method is its ability to provide more accurate and detailed cost information. This enhanced cost accuracy can greatly improve decision making within an organization.

However, ABC takes into account multiple cost drivers and assigns costs to activities that consume resources. This allows for a more accurate allocation of costs to products or services based on the actual activities that drive those costs.

For example, let’s say a company manufactures two products, Product A and Product B. Traditional costing methods may allocate overhead costs based solely on direct labor hours. However, if Product A requires more machine setup time and material handling compared to Product B, ABC would allocate a higher portion of overhead costs to Product A. This would provide a more accurate representation of the true costs associated with each product, enabling managers to make better decisions about pricing, production volumes, and resource allocation.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.