Accidental Death Benefit Coverage: Examples and Explanation

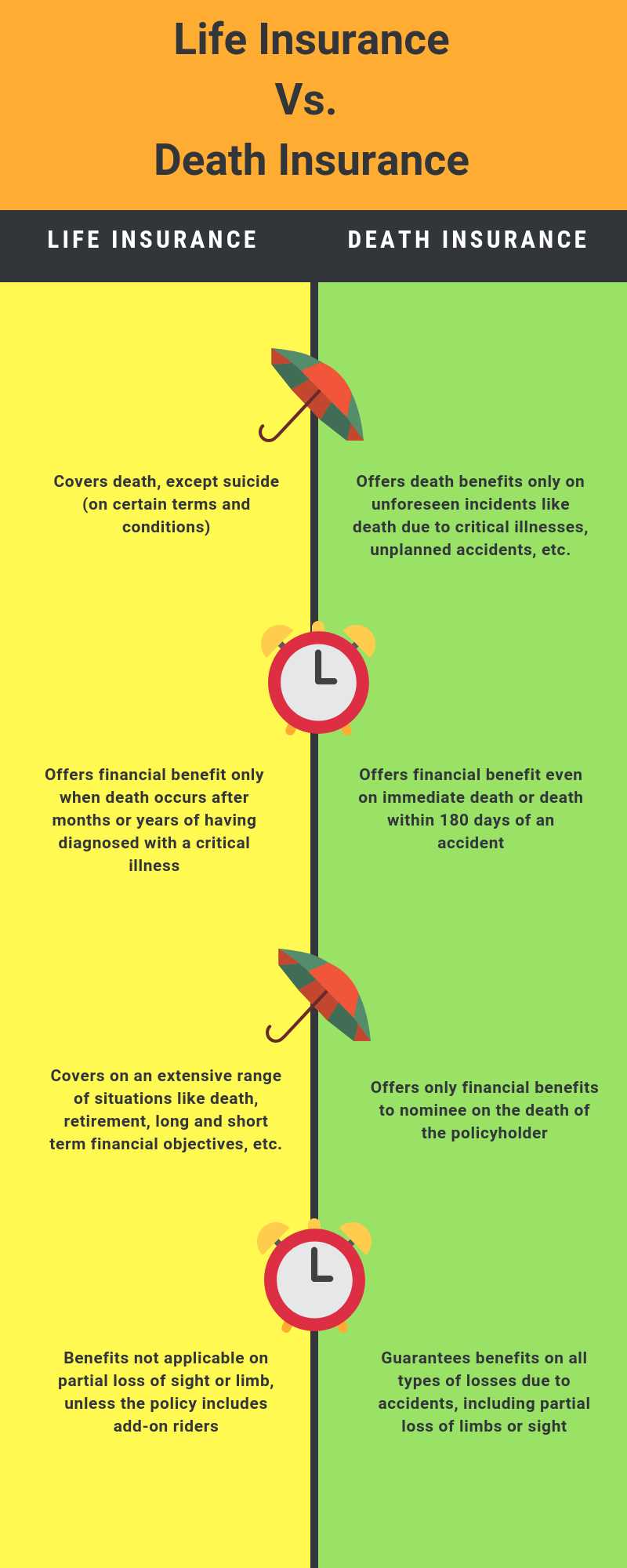

Accidental Death Benefit (ADB) coverage is a type of insurance policy that provides additional financial protection in the event of death resulting from an accident. While life insurance policies typically cover death from any cause, ADB coverage specifically focuses on accidental deaths.

How Does Accidental Death Benefit Coverage Work?

ADB coverage works by providing a lump sum payment to the designated beneficiaries if the insured person dies as a result of an accident. This coverage is usually offered as a rider or add-on to a primary life insurance policy, allowing policyholders to enhance their coverage and provide extra financial security for their loved ones.

For example, let’s say John has a life insurance policy with an ADB rider. If John dies in a car accident, his beneficiaries would receive the death benefit from the life insurance policy as well as an additional payout from the ADB coverage. This additional payout can help cover funeral expenses, medical bills, or any other financial obligations that may arise due to the accident.

What Types of Accidents Are Covered?

Why Consider Accidental Death Benefit Coverage?

Accidents can happen unexpectedly, and they can have a significant impact on the financial well-being of a family. Accidental Death Benefit coverage provides an extra layer of protection and peace of mind, ensuring that loved ones are financially supported in the event of an accidental death.

Additionally, ADB coverage can be particularly beneficial for individuals who engage in high-risk activities or have a higher likelihood of being involved in accidents due to their occupation or lifestyle. It offers an added level of security to mitigate the potential financial burden that may arise from an accidental death.

Overall, Accidental Death Benefit coverage is a valuable option to consider when purchasing life insurance. It provides an additional safety net for unforeseen circumstances and helps ensure that loved ones are taken care of financially in the event of an accidental death.

Accidental Death Benefit (ADB) coverage is a type of insurance policy that provides financial protection in the event of an accidental death. This coverage is designed to provide a lump sum payment to the beneficiary or beneficiaries named in the policy if the insured person dies as a result of an accident.

ADB coverage is often offered as an add-on to a life insurance policy, providing an additional layer of protection for unexpected accidents. It is important to note that ADB coverage only applies to accidental deaths and does not cover deaths resulting from natural causes or illnesses.

When considering ADB coverage, it is important to understand the specific terms and conditions of the policy. Some policies may have exclusions or limitations on coverage, such as specific types of accidents that are not covered or a waiting period before coverage takes effect.

ADB coverage can be beneficial for individuals who engage in high-risk activities or occupations, such as extreme sports or hazardous work environments. It can provide peace of mind knowing that financial protection is in place for loved ones in the event of an accidental death.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.