Late Fee Definition

A late fee is a penalty charged by a lender or service provider when a payment is not made by the due date. It is a way for companies to encourage timely payments and compensate for the additional administrative costs associated with late payments.

Late fees can be applied to various types of payments, such as credit card bills, utility bills, rent, or loan repayments. The specific amount of the late fee and the grace period before it is applied can vary depending on the terms and conditions set by the lender or service provider.

Late fees are typically stated in the contract or agreement between the borrower or customer and the lender or service provider. They are often expressed as a fixed amount or a percentage of the overdue payment. For example, a credit card company may charge a late fee of $25 or 5% of the minimum payment, whichever is greater.

To avoid late fees, it is essential to make payments on time. This can be achieved by setting up automatic payments, using reminder tools or apps, or simply being diligent about keeping track of due dates. It is also advisable to review the terms and conditions of any agreements to understand the late fee policy and any grace periods that may be available.

Late fees can be found in various financial products, such as credit cards, loans, mortgages, and utility bills. The specific terms and conditions regarding late fees are usually outlined in the contract or agreement you signed when you obtained the financial product or service.

It’s also worth mentioning that late fees can have a negative impact on your credit score. When you fail to make a payment on time, it can be reported to credit bureaus, which can lower your credit score. A lower credit score can make it more difficult to obtain credit in the future or result in higher interest rates.

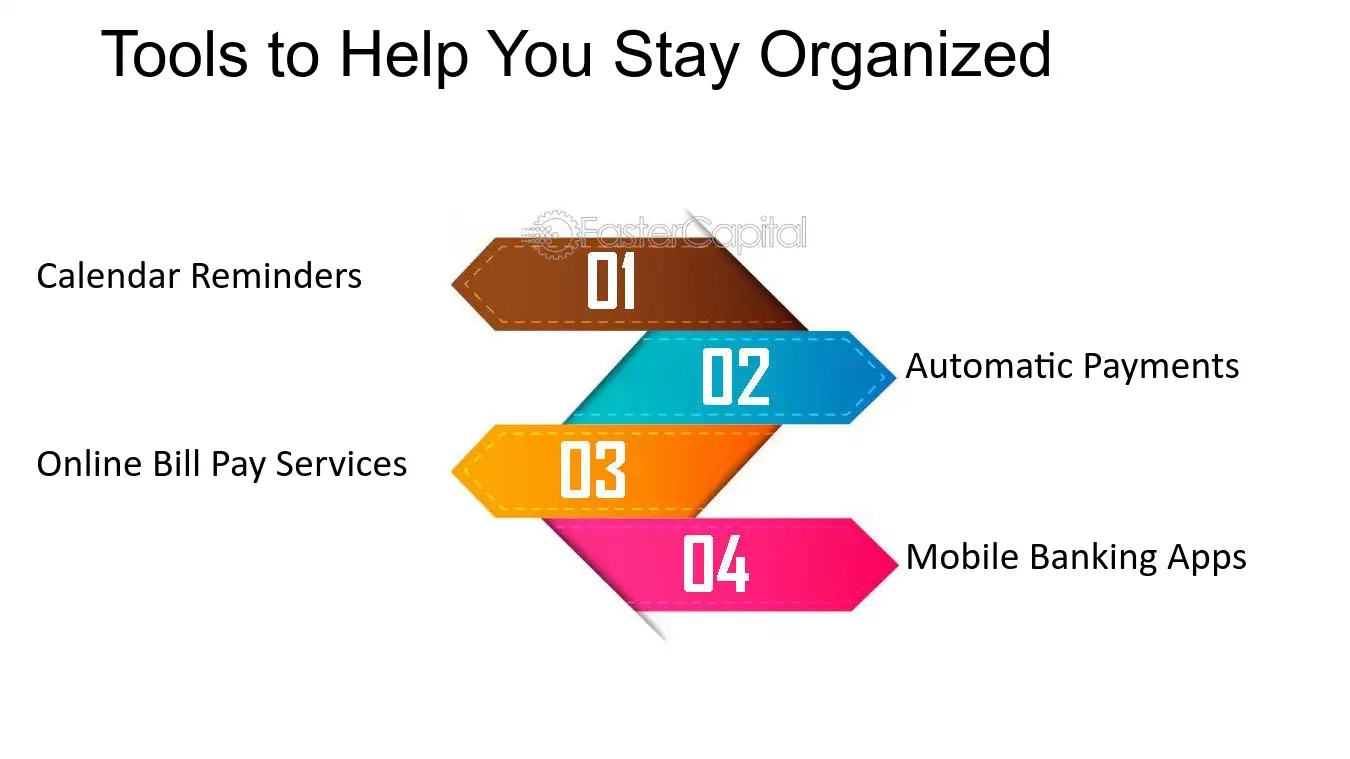

To avoid late fees, it’s crucial to stay organized and make payments on time. Here are some tips to help you avoid late fees:

| 1. Set up reminders: | Use calendar alerts, smartphone apps, or automatic payment options to remind yourself of upcoming due dates. |

| 2. Create a budget: | Develop a budget that includes all your financial obligations and prioritize making timely payments. |

| 3. Automate payments: | Consider setting up automatic payments to ensure that your bills are paid on time. |

| 4. Pay more than the minimum: | If possible, try to pay more than the minimum payment required to reduce your outstanding balance. |

| 5. Communicate with lenders: | If you’re facing financial difficulties, reach out to your lenders to discuss possible solutions or payment arrangements. |

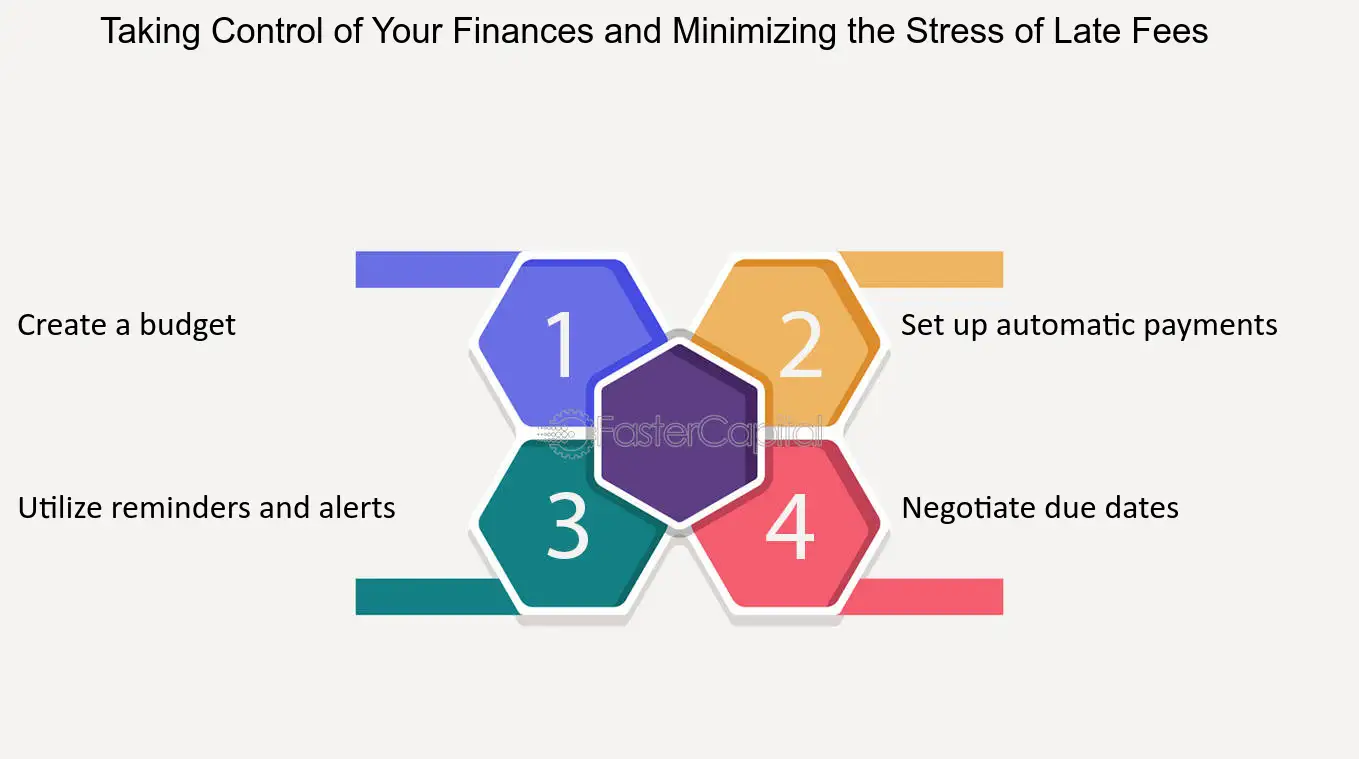

Tips to Avoid Late Fees

Late fees can be frustrating and costly, but there are several steps you can take to avoid them. By being proactive and staying organized, you can ensure that you never have to deal with the hassle of late fees again. Here are some tips to help you avoid late fees:

1. Set Up Automatic Payments:

One of the easiest ways to avoid late fees is to set up automatic payments for your bills. Most banks and credit card companies offer this service, allowing you to schedule payments to be made on a specific date each month. By doing this, you can ensure that your bills are always paid on time, eliminating the risk of late fees.

2. Create a Bill Payment Schedule:

Another effective way to avoid late fees is to create a bill payment schedule. This involves listing all of your bills, their due dates, and the amount due. By keeping track of your bills in one place, you can easily see when each payment is due and ensure that you make the necessary payments on time.

3. Set Reminders:

If you prefer not to set up automatic payments, you can use reminders to help you remember when your bills are due. This can be as simple as setting an alarm on your phone or using a calendar app to send you notifications. By setting reminders, you can stay on top of your bills and avoid late fees.

4. Pay Early:

Instead of waiting until the due date to make your payments, consider paying early. By doing this, you can avoid any potential delays or issues that may arise, such as mail delivery problems or technical difficulties. Paying early ensures that your payment is received on time and helps you avoid late fees.

5. Keep an Emergency Fund:

Having an emergency fund can be a lifesaver when unexpected expenses arise. By having money set aside specifically for emergencies, you can avoid the need to rely on credit cards or loans to cover these expenses. This can help you avoid late fees that may result from missed or late payments.

6. Communicate with Creditors:

If you are facing financial difficulties and are unable to make a payment on time, it is important to communicate with your creditors. Many creditors are willing to work with you to create a payment plan or offer temporary relief if you are experiencing financial hardship. By reaching out and explaining your situation, you may be able to avoid late fees or negotiate more manageable payment terms.

By following these tips, you can take control of your finances and avoid the frustration and expense of late fees. Remember, being proactive and staying organized are key to avoiding late fees and maintaining a healthy financial life.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.