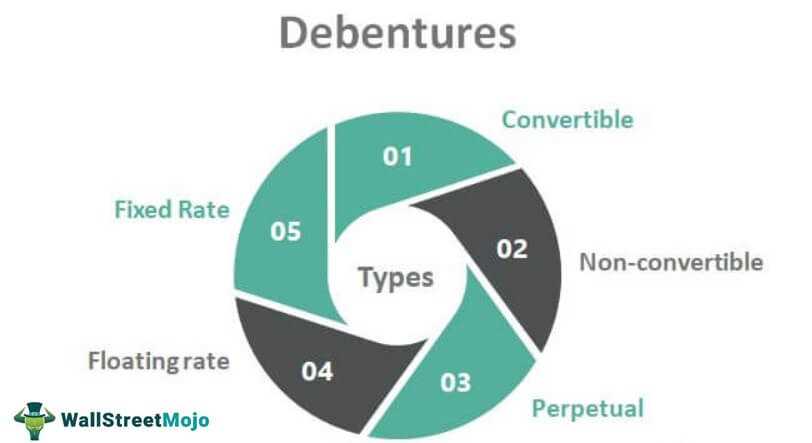

Types of Debenture

5. Redeemable Debentures: Redeemable debentures are debentures that have a fixed maturity date at which the principal amount is repaid to the debenture holders. These debentures are typically issued for a specific period of time, after which they are redeemed by the issuing company. Redeemable debentures provide investors with a known repayment date.

| Type | Convertible | Non-Convertible | Secured | Unsecured | Redeemable | Irredeemable |

|---|---|---|---|---|---|---|

| Features | Can be converted into equity shares | Cannot be converted into equity shares | Backed by specific assets | Not backed by specific assets | Has a fixed maturity date | Does not have a fixed maturity date |

Features of Debenture

A debenture is a type of debt instrument that is issued by a company or government entity to raise capital. It is a form of long-term borrowing that provides investors with a fixed interest rate and a specified repayment date. Here are some key features of debentures:

1. Fixed Interest Rate

Debentures typically offer a fixed interest rate, which means that the issuer agrees to pay a specific amount of interest to the debenture holders at regular intervals. This fixed rate provides investors with a predictable income stream and helps to attract investors who are seeking stable returns.

2. Maturity Date

3. Secured or Unsecured

Debentures can be either secured or unsecured. Secured debentures are backed by specific assets of the issuer, such as property or equipment, which serve as collateral in case of default. Unsecured debentures, on the other hand, are not backed by any specific assets and rely solely on the creditworthiness of the issuer.

4. Priority of Payment

In the event of bankruptcy or liquidation, debenture holders have a higher priority of payment compared to shareholders. This means that debenture holders are more likely to receive their principal and interest payments before shareholders receive any distribution of assets. This priority of payment makes debentures a relatively safer investment compared to equity securities.

5. Transferability

Debentures are generally transferable, which means that investors can buy and sell them on the secondary market. This provides investors with liquidity and the ability to exit their investment before the maturity date if needed. However, the transferability of debentures may be subject to certain restrictions imposed by the issuer.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.