Receivables Turnover Ratio: Formula, Importance, Examples, Limitations

The receivables turnover ratio is a financial ratio that measures how efficiently a company collects its accounts receivable. It is an important metric for assessing a company’s liquidity and its ability to manage its cash flow effectively. The formula for calculating the receivables turnover ratio is:

Receivables Turnover Ratio = Net Credit Sales / Average Accounts Receivable

This ratio indicates the number of times a company collects its average accounts receivable balance during a specific period, usually a year. A higher receivables turnover ratio suggests that a company is collecting its receivables more quickly, which is generally a positive sign. Conversely, a lower ratio may indicate that a company is having difficulty collecting its receivables in a timely manner.

Importance of the Receivables Turnover Ratio

The receivables turnover ratio is important for several reasons:

- Assessing liquidity: The ratio helps determine how quickly a company can convert its receivables into cash, which is crucial for maintaining liquidity.

- Evaluating credit policies: A high turnover ratio may indicate that a company has strict credit policies and is able to collect its receivables promptly. On the other hand, a low ratio may suggest that a company needs to review its credit policies and collection efforts.

- Identifying potential cash flow issues: A declining turnover ratio over time may indicate that a company is experiencing difficulties in collecting its receivables, which could lead to cash flow problems.

- Comparing industry benchmarks: The receivables turnover ratio can be used to compare a company’s performance to industry benchmarks. This can help identify areas where a company may be falling behind or excelling.

Examples and Limitations

For example, let’s say Company A has net credit sales of $1,000,000 and an average accounts receivable balance of $200,000. The receivables turnover ratio would be calculated as follows:

Receivables Turnover Ratio = $1,000,000 / $200,000 = 5

This means that Company A collects its average accounts receivable balance five times during the year.

The receivables turnover ratio is a financial metric that measures how efficiently a company manages its accounts receivable. It indicates the number of times a company collects its average accounts receivable balance during a specific period, usually a year. This ratio is an important indicator of a company’s liquidity and its ability to collect cash from its customers.

Formula

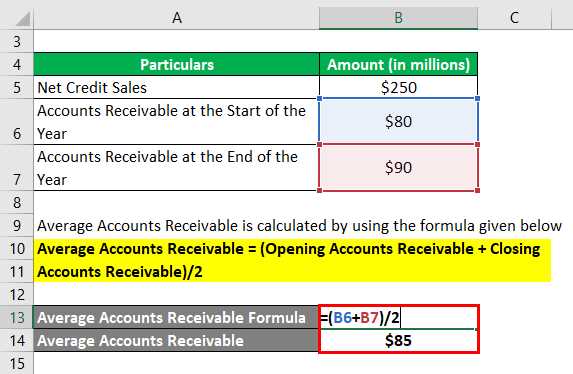

The formula for calculating the receivables turnover ratio is:

Receivables Turnover Ratio = Net Credit Sales / Average Accounts Receivable

Net credit sales refer to the total sales made on credit during a specific period, excluding any cash sales. Average accounts receivable is calculated by adding the beginning and ending accounts receivable balances and dividing the sum by 2.

Importance

The receivables turnover ratio is important for several reasons:

- It provides insights into a company’s efficiency in collecting payments from its customers. A higher ratio indicates that the company is collecting its receivables quickly, while a lower ratio suggests that the company may be facing difficulties in collecting payments.

- It helps in assessing the effectiveness of a company’s credit and collection policies. A low ratio may indicate that the company needs to tighten its credit policies or improve its collection efforts.

- It can be used to compare a company’s performance with its industry peers. A higher ratio than the industry average may indicate that the company is managing its receivables better than its competitors.

Limitations

While the receivables turnover ratio is a useful metric, it has some limitations:

- It does not consider the quality of the receivables. A company may have a high turnover ratio but still face difficulties in collecting payments if its receivables are of low quality, such as those from customers with a history of late payments or financial instability.

- It does not provide information about the collection period. A company may have a high turnover ratio but take a long time to collect payments, which can affect its cash flow.

Importance of the Receivables Turnover Ratio

The receivables turnover ratio is an important financial metric that helps businesses assess their efficiency in collecting payments from customers. It measures how quickly a company is able to convert its accounts receivable into cash. A high receivables turnover ratio indicates that a company is effectively managing its credit and collection policies, while a low ratio may suggest problems with credit control or collection efforts.

1. Assessing Liquidity

One of the key benefits of the receivables turnover ratio is its ability to provide insights into a company’s liquidity. By analyzing how quickly a company is able to collect payments from customers, it helps determine the availability of cash to meet short-term obligations. A high turnover ratio indicates that a company has a strong cash flow and can easily cover its expenses, while a low ratio may indicate potential cash flow problems.

2. Evaluating Credit Policies

The receivables turnover ratio also helps evaluate the effectiveness of a company’s credit policies. By measuring the speed at which customers pay their invoices, it provides valuable information about the credit terms and conditions offered by the company. A high turnover ratio suggests that customers are paying their bills promptly, indicating that the credit policies are favorable and well-managed. On the other hand, a low ratio may indicate that customers are taking longer to pay, potentially signaling a need to revise credit terms or tighten credit control.

Example: Company A has a receivables turnover ratio of 10, while Company B has a ratio of 5. This means that Company A is collecting payments from customers twice as fast as Company B, indicating better credit management and collection efforts.

3. Identifying Collection Issues

The receivables turnover ratio can also help identify potential collection issues. If the ratio decreases over time or falls below industry benchmarks, it may indicate problems with collecting payments from customers. This could be due to issues such as ineffective collection procedures, customer disputes, or financial difficulties faced by customers. By monitoring the trend of the ratio, companies can identify collection issues early on and take appropriate actions to address them, such as implementing stricter credit control measures or offering incentives for prompt payment.

4. Comparing Performance

The receivables turnover ratio is a useful tool for comparing a company’s performance against industry peers or historical data. By benchmarking the ratio against industry averages or previous periods, companies can assess their efficiency in managing receivables and identify areas for improvement. It allows businesses to gauge their performance and make informed decisions regarding credit policies, collection efforts, and overall financial management.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.