Qualified Retirement Plan Definition

A qualified retirement plan is a type of retirement savings account that is established by an employer for the benefit of their employees. These plans are designed to provide employees with a way to save for retirement and receive certain tax advantages.

There are two main types of qualified retirement plans: defined benefit plans and defined contribution plans. Both types of plans have their own unique features and benefits.

A defined contribution plan, on the other hand, is a retirement plan in which the employer and/or employee contribute funds to an individual account for the employee. The amount of the benefit that the employee receives upon retirement depends on the contributions made to the account and the investment performance of those contributions. This type of plan does not provide a guaranteed income stream, but instead allows employees to accumulate savings for retirement.

Qualified retirement plans are important because they provide employees with a way to save for retirement and receive certain tax advantages. Contributions made to these plans are typically tax-deductible, meaning that employees can reduce their taxable income by contributing to their retirement accounts. Additionally, the investment earnings on these contributions are tax-deferred, meaning that employees do not have to pay taxes on the earnings until they withdraw the funds in retirement.

What is a Qualified Retirement Plan?

A qualified retirement plan is a type of retirement savings account that is established by an employer for the benefit of its employees. These plans are designed to provide employees with a way to save for their retirement and receive certain tax advantages.

To be considered qualified, a retirement plan must meet certain requirements set forth by the Internal Revenue Service (IRS). These requirements include rules regarding eligibility, contribution limits, vesting schedules, and distribution rules.

One of the main benefits of a qualified retirement plan is the ability to defer taxes on contributions and investment earnings until the funds are withdrawn. This allows individuals to potentially grow their retirement savings more quickly than if they were subject to immediate taxation.

Qualified retirement plans can take various forms, including defined contribution plans and defined benefit plans. Defined contribution plans, such as 401(k) plans, allow employees to contribute a portion of their salary to the plan on a pre-tax basis. These contributions are then invested and grow tax-deferred until retirement.

On the other hand, defined benefit plans, such as pension plans, provide employees with a specific benefit amount upon retirement. The employer is responsible for funding these plans and determining the benefit amount based on factors such as salary and years of service.

Overall, qualified retirement plans play a crucial role in helping individuals save for their retirement and provide them with certain tax advantages. They offer employees a way to accumulate wealth over time and ensure a financially secure future.

Importance of Qualified Retirement Plans

Qualified retirement plans play a crucial role in providing individuals with a secure financial future during their retirement years. These plans offer employees a way to save and invest for retirement, ensuring that they have enough income to support themselves when they are no longer working.

One of the key benefits of qualified retirement plans is that they provide individuals with tax advantages. Contributions made to these plans are typically tax-deductible, meaning that individuals can lower their taxable income by contributing to their retirement accounts. Additionally, the investment earnings within the plan are tax-deferred, allowing individuals to grow their retirement savings without having to pay taxes on the gains each year.

Another important aspect of qualified retirement plans is that many employers offer matching contributions. This means that for every dollar an employee contributes to their retirement account, the employer will also contribute a certain percentage. This employer match is essentially free money that individuals can use to boost their retirement savings.

Qualified retirement plans also provide individuals with a level of financial security. By contributing to these plans regularly, individuals can build a nest egg that will provide them with a steady stream of income during retirement. This income can help cover essential expenses, such as housing, healthcare, and daily living costs.

Furthermore, qualified retirement plans offer individuals the opportunity to diversify their investments. These plans typically offer a range of investment options, such as stocks, bonds, and mutual funds. By diversifying their investments, individuals can reduce the risk of losing all of their retirement savings if one investment performs poorly.

Main Types of Qualified Retirement Plans

Qualified retirement plans are designed to help individuals save for retirement while receiving certain tax advantages. There are several main types of qualified retirement plans, each with its own features and benefits. These plans include:

1. 401(k) Plans

A 401(k) plan is one of the most popular types of qualified retirement plans. It is offered by employers to their employees, allowing them to contribute a portion of their salary to the plan on a pre-tax basis. The contributions are invested in a variety of investment options, such as stocks, bonds, and mutual funds. The earnings on the investments grow tax-deferred until withdrawal.

One of the key advantages of a 401(k) plan is that employers often match a portion of the employee’s contributions, providing additional retirement savings. Additionally, 401(k) plans have higher contribution limits compared to other retirement plans, allowing individuals to save more for their future.

2. Individual Retirement Accounts (IRAs)

Individual Retirement Accounts, or IRAs, are another type of qualified retirement plan. Unlike 401(k) plans, IRAs are not tied to an employer and can be opened by individuals on their own. There are two main types of IRAs: Traditional IRAs and Roth IRAs.

Traditional IRAs allow individuals to make tax-deductible contributions, which means that the contributions are not taxed until withdrawal during retirement. The earnings on the investments also grow tax-deferred. On the other hand, Roth IRAs do not offer tax-deductible contributions, but the withdrawals during retirement are tax-free, including the earnings on the investments.

IRAs have lower contribution limits compared to 401(k) plans, but they provide individuals with more flexibility and control over their investments.

3. Pension Plans

Overall, qualified retirement plans offer individuals a way to save for retirement while receiving tax advantages. Whether it’s through a 401(k) plan, an IRA, or a pension plan, these plans provide individuals with the opportunity to secure their financial future and enjoy a comfortable retirement.

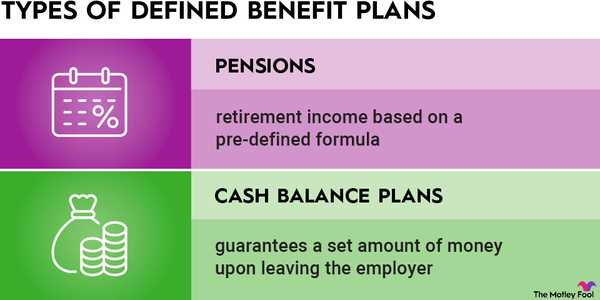

Defined Benefit Plans

A defined benefit plan is a type of qualified retirement plan that guarantees a specific benefit amount to employees upon retirement. This type of plan is often offered by employers and is designed to provide a steady stream of income during retirement.

One of the main advantages of a defined benefit plan is that it provides a predictable income stream for retirees. Unlike other types of retirement plans, such as defined contribution plans, the benefit amount is not dependent on the performance of investments. This can provide peace of mind for employees who may be concerned about market fluctuations.

Another advantage of defined benefit plans is that they often provide higher benefit amounts compared to other types of retirement plans. This can be especially beneficial for employees who have spent many years with a company and have a higher salary at retirement.

However, there are also some disadvantages to defined benefit plans. One disadvantage is that they can be more costly for employers to fund compared to other types of retirement plans. This is because the employer is responsible for ensuring that there are enough funds in the plan to meet the future benefit obligations.

Additionally, defined benefit plans may have stricter eligibility requirements compared to other types of retirement plans. This means that not all employees may be eligible to participate in the plan, which can be a disadvantage for those who do not meet the requirements.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.