What are Qualified Adoption Expenses?

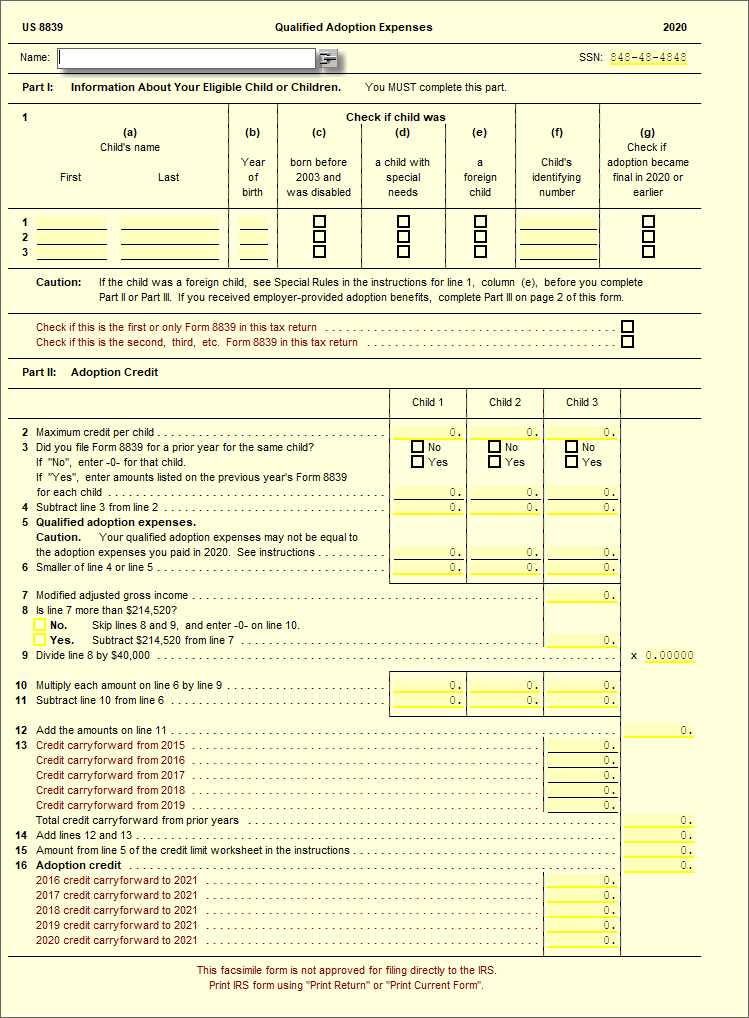

Qualified Adoption Expenses (QAE) refer to the necessary expenses incurred by individuals or couples during the adoption process. These expenses are eligible for certain tax benefits and deductions, making them an important consideration for those looking to adopt.

QAE can include a wide range of costs associated with the adoption process, such as:

- Adoption agency fees

- Legal fees

- Home study fees

- Travel expenses

- Medical expenses for the birth mother

- Court costs

Utilizing QAE Benefits

1. Keep Detailed Records

It’s crucial to keep detailed records of all your adoption expenses. This includes receipts, invoices, and any other relevant documentation. By maintaining organized records, you’ll have a clear overview of your expenses and be able to easily determine which expenses qualify for QAE benefits.

2. Consult with a Tax Professional

Consulting with a tax professional who specializes in adoption tax credits can be extremely beneficial. They can help you navigate the complex tax laws and ensure that you are maximizing your QAE benefits. A tax professional can also assist you in properly documenting your expenses and filing your taxes correctly.

3. Understand Eligibility Requirements

4. File Your Taxes Correctly

When it comes time to file your taxes, make sure you accurately report your adoption expenses and claim the QAE benefits you are eligible for. Double-check all the information you provide and ensure that you have included all the necessary documentation to support your claims. Filing your taxes correctly will help you avoid any potential issues or audits in the future.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.