What is a Phantom Stock Plan?

A Phantom Stock Plan is a type of employee compensation plan that provides employees with a virtual ownership interest in the company. Unlike traditional stock options or equity grants, phantom stock does not represent actual ownership in the company, but rather a promise to pay out a certain amount of money based on the value of the company’s stock.

Under a Phantom Stock Plan, employees are granted “phantom” or “shadow” shares, which mirror the value of the company’s actual shares. These phantom shares are typically subject to vesting schedules and other conditions, similar to traditional equity grants.

When the value of the company’s stock increases, the value of the phantom shares also increases. Employees are then entitled to receive a cash payout equivalent to the increase in value of their phantom shares. This payout is typically made upon a triggering event, such as a change of control or an initial public offering (IPO).

Phantom Stock Plans are often used by privately held companies that want to provide their employees with a stake in the company’s success, without actually granting them ownership rights. This can be particularly useful for companies that do not want to dilute their ownership or deal with the complexities of issuing actual stock.

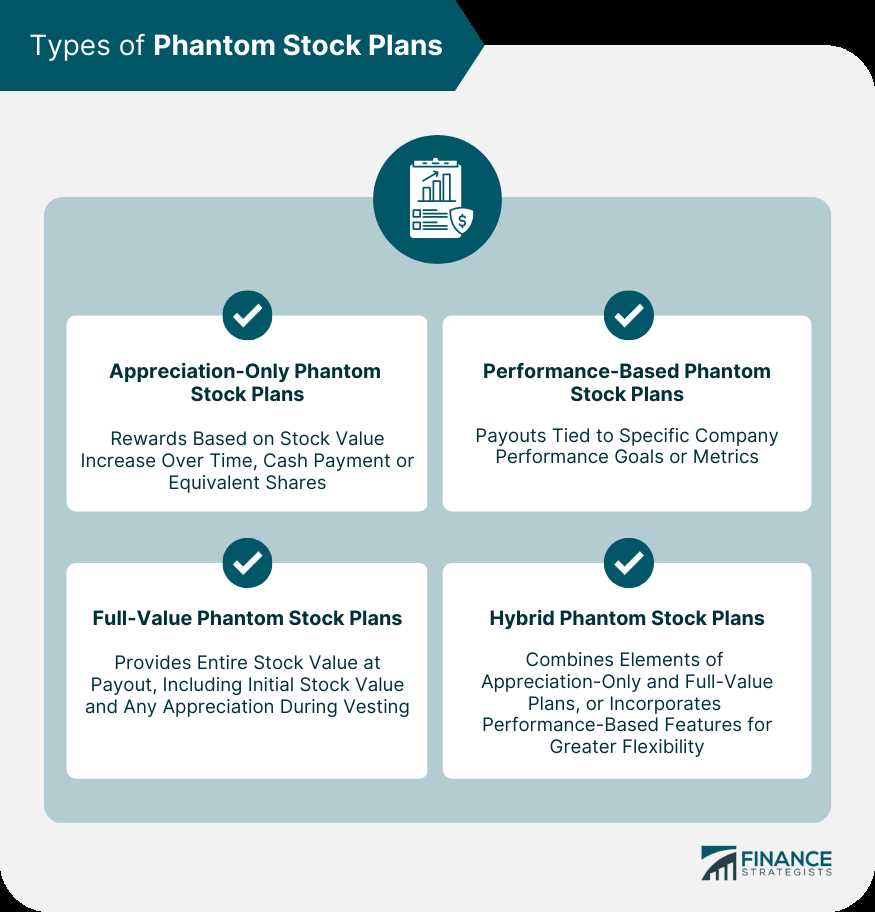

A phantom stock plan is a type of employee compensation plan that gives employees the opportunity to receive cash or stock-based rewards based on the performance of the company’s stock, without actually owning any company stock. There are two main types of phantom stock plans: appreciation-only plans and full-value plans.

Appreciation-Only Plans

In an appreciation-only phantom stock plan, employees are granted a certain number of phantom shares. These shares do not have any actual value, but they track the value of the company’s stock. When the company’s stock price increases, the value of the phantom shares also increases. At a predetermined date or event, such as retirement or a change in control of the company, employees are paid the appreciation in value of their phantom shares in cash or company stock.

This type of plan is often used to incentivize employees to help increase the value of the company’s stock. It aligns the interests of the employees with the shareholders, as both parties benefit from the increase in stock price. Additionally, appreciation-only plans can help retain key employees by providing them with a potential financial reward tied to the company’s success.

Full-Value Plans

In a full-value phantom stock plan, employees are granted a certain number of phantom shares that have a predetermined value. This value is typically based on the current market price of the company’s stock at the time of grant. Unlike appreciation-only plans, full-value plans provide employees with the full value of their phantom shares, regardless of any increase or decrease in the company’s stock price.

When the predetermined date or event occurs, employees are paid the full value of their phantom shares in cash or company stock. This type of plan is often used when the company wants to provide employees with a guaranteed financial reward, regardless of the performance of the company’s stock.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.