Interest Rate Swap: Definition, Types, and Real-World Example

An interest rate swap is a financial derivative instrument that allows two parties to exchange interest rate payments on a specified notional amount over a set period of time. It is a popular tool used by businesses and investors to manage their exposure to interest rate fluctuations.

There are several types of interest rate swaps, including:

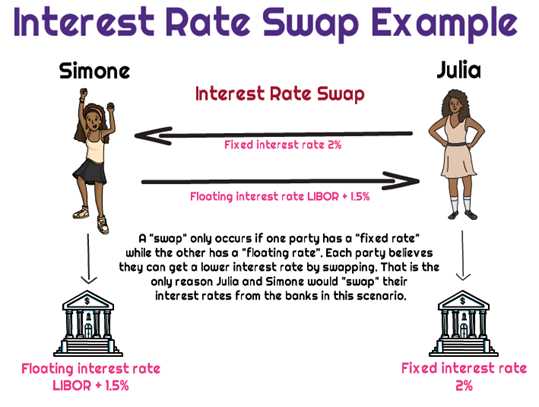

Let’s consider a real-world example to understand how interest rate swaps work:

Company A has borrowed money at a fixed interest rate of 5% per annum, while Company B has borrowed money at a floating interest rate based on LIBOR. Company A is concerned about the potential increase in interest rates, while Company B is concerned about the potential decrease in interest rates.

To manage their interest rate risks, Company A and Company B enter into a fixed-for-floating interest rate swap. Company A agrees to pay Company B a fixed interest rate of 4.5% per annum, while Company B agrees to pay Company A a floating interest rate based on LIBOR.

As a result of the swap, Company A effectively converts its fixed interest rate into a floating interest rate, reducing its exposure to potential interest rate increases. On the other hand, Company B effectively converts its floating interest rate into a fixed interest rate, reducing its exposure to potential interest rate decreases.

By entering into an interest rate swap, both parties are able to manage their interest rate risks and potentially benefit from the differences in interest rates.

An interest rate swap is a financial derivative instrument that allows two parties to exchange interest rate payments. It involves the exchange of cash flows based on a notional principal amount. The purpose of an interest rate swap is to manage or hedge interest rate risk. It allows companies or individuals to transform their exposure to variable interest rates into fixed interest rates or vice versa.

Interest rate swaps can be used by various market participants, including banks, corporations, and institutional investors. They are commonly used to hedge against interest rate fluctuations or to speculate on interest rate movements.

How Interest Rate Swaps Work

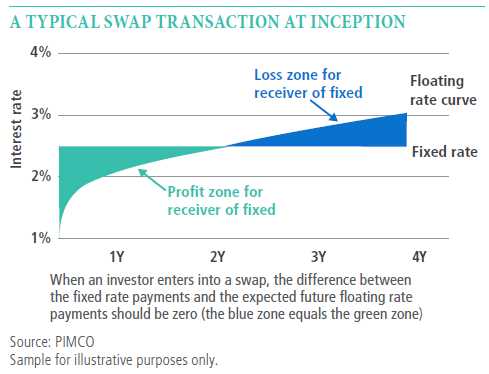

In an interest rate swap, two parties agree to exchange interest payments based on a specified notional amount. The notional amount is the hypothetical amount on which the interest payments are calculated, and it is not exchanged between the parties.

Typically, one party pays a fixed interest rate, while the other party pays a floating interest rate. The floating interest rate is usually based on a reference rate, such as LIBOR (London Interbank Offered Rate) or EURIBOR (Euro Interbank Offered Rate), plus a spread.

The interest rate payments are calculated periodically, such as quarterly or semi-annually, and are based on the notional amount and the agreed-upon interest rates. The party paying the fixed interest rate receives the floating interest rate payments, while the party paying the floating interest rate receives the fixed interest rate payments.

Interest rate swaps can have different structures and maturities. They can be structured as plain vanilla swaps, where the notional amount remains constant throughout the life of the swap, or as amortizing swaps, where the notional amount decreases over time.

Benefits and Risks of Interest Rate Swaps

Interest rate swaps offer several benefits to market participants. They allow companies to manage their interest rate exposure and hedge against interest rate risk. By swapping variable interest rate payments for fixed interest rate payments or vice versa, companies can protect themselves from adverse interest rate movements.

Interest rate swaps also provide market participants with the opportunity to speculate on interest rate movements. If a party believes that interest rates will increase, they can enter into an interest rate swap to receive fixed interest rate payments and benefit from the expected rate hike.

However, interest rate swaps also come with risks. One of the main risks is counterparty risk, which is the risk that one of the parties involved in the swap will default on their obligations. Market participants should carefully assess the creditworthiness of their counterparties before entering into an interest rate swap.

Another risk is interest rate risk, which is the risk that interest rates will move in an unfavorable direction. If a party has swapped variable interest rate payments for fixed interest rate payments and interest rates decrease, they may miss out on potential savings.

Types of Interest Rate Swaps

An interest rate swap is a financial derivative instrument that allows two parties to exchange interest rate payments. There are several types of interest rate swaps, each with its own characteristics and purpose. Here are the most common types:

1. Fixed-for-Floating Interest Rate Swap

In a fixed-for-floating interest rate swap, one party agrees to pay a fixed interest rate while the other party agrees to pay a floating interest rate. This type of swap is commonly used to manage interest rate risk. For example, a company with a variable-rate loan may enter into a fixed-for-floating interest rate swap to convert the variable rate into a fixed rate, providing stability in interest payments.

2. Basis Swap

A basis swap involves the exchange of two floating interest rates based on different reference rates. The purpose of a basis swap is to take advantage of differences in interest rates between two markets or to hedge against interest rate risk. For instance, if a company has floating-rate debt tied to one reference rate but wants to align its interest payments with another reference rate, it can enter into a basis swap.

3. Forward Rate Agreement (FRA)

A forward rate agreement (FRA) is a short-term interest rate swap. It allows two parties to agree on an interest rate that will apply to a future period. FRAs are commonly used to hedge against interest rate fluctuations or to speculate on future interest rate movements. For example, a company expecting to take out a loan in six months may enter into an FRA to lock in the interest rate for that future loan.

4. Overnight Index Swap (OIS)

These are just a few examples of the types of interest rate swaps available in the financial markets. Each type serves a specific purpose and can be tailored to meet the needs of the parties involved. Interest rate swaps are valuable tools for managing interest rate risk, hedging, and speculating on future interest rate movements.

Real-World Example of Interest Rate Swap

An interest rate swap is a financial derivative instrument that allows two parties to exchange interest rate payments. It is commonly used to manage interest rate risk or to take advantage of differences in interest rates between two countries or markets. Here is a real-world example to illustrate how an interest rate swap works.

Let’s consider a hypothetical scenario where Company A, a multinational corporation based in the United States, wants to expand its operations in Europe. However, it is concerned about the potential fluctuations in interest rates that could affect its borrowing costs.

Company A decides to enter into an interest rate swap agreement with Company B, a European financial institution. The terms of the swap agreement state that Company A will pay a fixed interest rate to Company B, while Company B will pay a floating interest rate to Company A.

Company A anticipates that interest rates in the United States will increase in the future, while Company B believes that interest rates in Europe will remain relatively stable. By entering into the swap agreement, Company A effectively converts its variable interest rate on its debt into a fixed interest rate, thereby protecting itself from potential interest rate hikes.

On the other hand, Company B benefits from the swap agreement by receiving a fixed interest rate, which it can use to hedge against any potential decrease in interest rates in Europe.

Over the duration of the swap agreement, Company A will make fixed interest rate payments to Company B based on the agreed-upon notional amount. In return, Company A will receive floating interest rate payments from Company B, which are determined by a reference interest rate, such as LIBOR (London Interbank Offered Rate).

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.