Holding Company: Advantages and Disadvantages

A holding company is a type of business entity that owns and controls other companies, called subsidiaries. It is formed with the purpose of owning stock or other equity interests in other companies, rather than engaging in day-to-day operations.

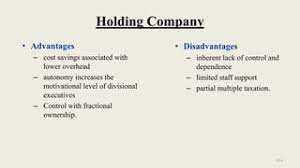

Advantages of a Holding Company

1. Asset Protection: One of the main advantages of a holding company is that it provides a layer of protection for the assets of the subsidiaries. Since the holding company owns the subsidiaries, any liabilities or legal issues faced by the subsidiaries are generally limited to the assets of those specific subsidiaries. This can help protect the assets of the overall business.

2. Tax Benefits: Holding companies can also provide tax advantages. By structuring the ownership of the subsidiaries in a certain way, the holding company can minimize its overall tax liability. This can include taking advantage of tax incentives, deductions, and exemptions available to holding companies.

3. Efficient Management: Another advantage of a holding company is that it allows for efficient management of multiple businesses. The holding company can centralize certain functions, such as finance, legal, and human resources, which can lead to cost savings and improved coordination between subsidiaries. This can also result in better decision-making and strategic planning.

Disadvantages of a Holding Company

1. Complexity: Operating a holding company can be complex and require specialized knowledge and expertise. The structure and management of the holding company and its subsidiaries can be more intricate than a traditional business. This complexity can result in higher administrative and legal costs.

2. Regulatory Compliance: Holding companies are subject to various regulations and compliance requirements. They may need to adhere to specific reporting and disclosure requirements, as well as comply with industry-specific regulations. Failing to meet these requirements can result in penalties and legal consequences.

3. Dependency on Subsidiaries: A holding company’s success is dependent on the performance and success of its subsidiaries. If the subsidiaries face financial difficulties or fail, it can negatively impact the holding company’s overall financial health. This dependency on subsidiaries can introduce additional risks and uncertainties.

Benefits of a Holding Company

Diversification

One of the main advantages of a holding company is the ability to diversify its investments. By owning multiple subsidiaries in different industries or sectors, a holding company can spread its risk and reduce its exposure to any single market or industry. This diversification can help protect the overall value of the company and provide stability during economic downturns.

Tax Benefits

A holding company can also provide tax advantages. By structuring the ownership of its subsidiaries in a strategic way, a holding company can take advantage of tax incentives and lower its overall tax liability. This can result in significant cost savings for the company and increase its profitability.

Additionally, a holding company can benefit from tax deferral strategies. By reinvesting profits from one subsidiary into another, a holding company can delay paying taxes on those profits until they are distributed as dividends. This can provide the company with more working capital and allow for further growth and expansion.

Asset Protection

Another benefit of a holding company is asset protection. By separating the assets and liabilities of each subsidiary, a holding company can shield itself from the financial risks and legal claims that may arise from the operations of its subsidiaries. This can help protect the overall wealth of the company and its shareholders.

Efficient Management

A holding company can also lead to more efficient management. By centralizing certain functions, such as finance, human resources, and legal, a holding company can streamline operations and reduce costs. This can result in improved profitability and allow for better allocation of resources across the subsidiaries.

Drawbacks of a Holding Company

A holding company, despite its many benefits, also has a few drawbacks that should be taken into consideration. These drawbacks include:

| 1. Complexity and Administrative Burden | Operating a holding company can be complex and require a significant amount of administrative work. This includes managing multiple subsidiaries, coordinating financial statements, and ensuring compliance with legal and regulatory requirements. |

| 2. Lack of Control | While a holding company has ownership of its subsidiaries, it may not have direct control over their operations. This can lead to challenges in decision-making and coordination, especially if the subsidiaries have different goals or strategies. |

| 3. Financial Risks | A holding company may be exposed to financial risks associated with its subsidiaries. If one or more subsidiaries face financial difficulties or bankruptcy, it can have a negative impact on the overall financial health of the holding company. |

| 4. Tax Implications | There can be complex tax implications associated with operating a holding company. Depending on the jurisdiction and structure of the holding company, there may be additional taxes or restrictions that need to be considered. |

| 5. Limited Liability Protection | While a holding company provides limited liability protection for its shareholders, it may not offer the same level of protection for the subsidiaries. Creditors or legal claims against the subsidiaries may still have the ability to reach the assets of the holding company. |

Despite these drawbacks, a holding company can still be a valuable and effective business structure for certain situations. It is important for businesses to carefully evaluate the advantages and disadvantages before deciding to establish a holding company.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.