Hodrick-Prescott Filter: Reasons to Avoid Using It

The Hodrick-Prescott (HP) filter is a commonly used method in financial analysis to decompose a time series into a trend component and a cyclical component. While it may seem like a useful tool, there are several reasons why it should be avoided.

1. Lack of Economic Interpretation

One of the main drawbacks of the HP filter is that it lacks economic interpretation. The filter is purely a mathematical technique that aims to smooth out fluctuations in a time series. However, it does not provide any insights into the underlying economic factors driving those fluctuations. This makes it difficult to draw meaningful conclusions from the filtered data.

2. Sensitivity to Parameter Choices

Another issue with the HP filter is its sensitivity to parameter choices. The filter requires the user to specify a smoothing parameter, which determines the amount of smoothing applied to the data. However, different parameter values can lead to significantly different results. This makes it challenging to compare and interpret the filtered data across different studies or time periods.

3. Distortion of Data

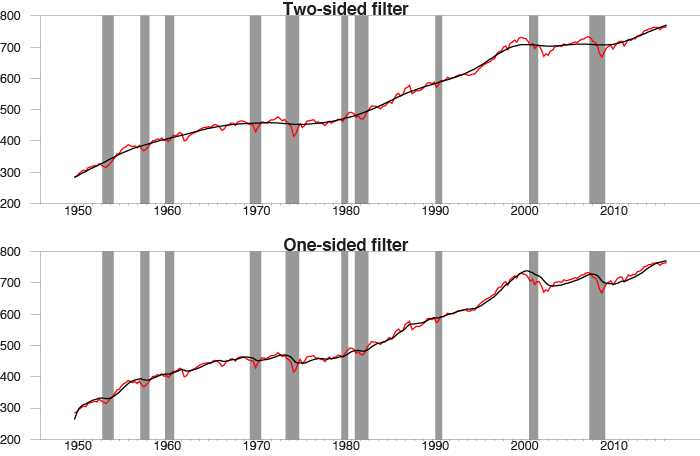

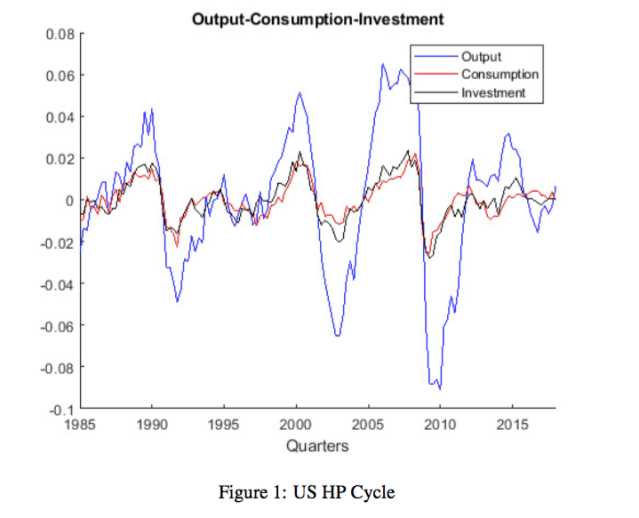

The HP filter has been criticized for its tendency to distort the original data. By separating a time series into trend and cyclical components, the filter can introduce artificial patterns and trends that may not reflect the true nature of the data. This can lead to misleading interpretations and erroneous conclusions.

Moreover, the filter is known to amplify noise and measurement errors, which can further distort the filtered data. This can be particularly problematic in financial analysis, where accurate and reliable data is crucial for making informed decisions.

Overall, while the Hodrick-Prescott filter may seem like a convenient tool for analyzing time series data, its limitations and drawbacks should be carefully considered. Alternative methods that provide more meaningful economic insights and are less prone to distortion may be more suitable for financial analysis.

Problems with Hodrick-Prescott Filter

The Hodrick-Prescott (HP) filter is a commonly used tool in financial analysis for decomposing a time series into its trend and cyclical components. However, despite its popularity, there are several problems associated with the use of the HP filter that should be considered.

1. Sensitivity to parameter selection: The HP filter requires the selection of a smoothing parameter, often denoted as λ. The choice of this parameter can have a significant impact on the results obtained from the filter. Different values of λ can lead to different trends and cyclical components, making it difficult to compare results across studies or time series.

2. Arbitrary assumption of linearity: The HP filter assumes that the trend component of a time series can be represented by a linear function. However, this assumption may not hold true for all time series. In reality, trends can exhibit non-linear patterns, which may not be accurately captured by the HP filter.

3. Data revisions: The HP filter is sensitive to data revisions. If the input data used in the filter is revised, it can lead to significant changes in the resulting trend and cyclical components. This can make it difficult to interpret and compare results over time.

4. Lack of economic interpretation: The HP filter is a purely statistical tool and does not provide any economic interpretation of the trend and cyclical components. It is important to note that the filter does not distinguish between structural changes in the data and temporary fluctuations, which can limit its usefulness in economic analysis.

5. Inability to handle outliers: The HP filter is sensitive to outliers in the data. If there are extreme values or anomalies in the time series, they can distort the resulting trend and cyclical components. This can lead to misleading conclusions and inaccurate predictions.

6. Over-smoothing: The HP filter can sometimes over-smooth the data, leading to the loss of important information. This can result in the filtering out of relevant cyclical components and trends, making it difficult to capture the true underlying patterns in the data.

Given these problems, it is important to exercise caution when using the Hodrick-Prescott filter in financial analysis. It is advisable to consider alternative methods and approaches that may better suit the specific characteristics of the data being analyzed.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.