Floating Interest Rate Explained: Definition, Working Mechanism, and Real-Life Examples

For example, let’s say you have a mortgage with a floating interest rate set at 2% above the prime rate. If the prime rate is currently 3%, your mortgage interest rate would be 5%. However, if the prime rate increases to 4%, your mortgage interest rate would also increase to 6%.

One of the advantages of a floating interest rate is that it can provide flexibility for borrowers. If interest rates are expected to decrease in the future, borrowers with floating interest rates may benefit from lower monthly payments. On the other hand, if interest rates are expected to rise, borrowers may face higher monthly payments.

Real-life examples of floating interest rates can be found in various financial products, such as adjustable-rate mortgages (ARMs), variable-rate student loans, and credit cards with variable interest rates. These products often come with initial fixed-rate periods, after which the interest rate starts to float based on market conditions.

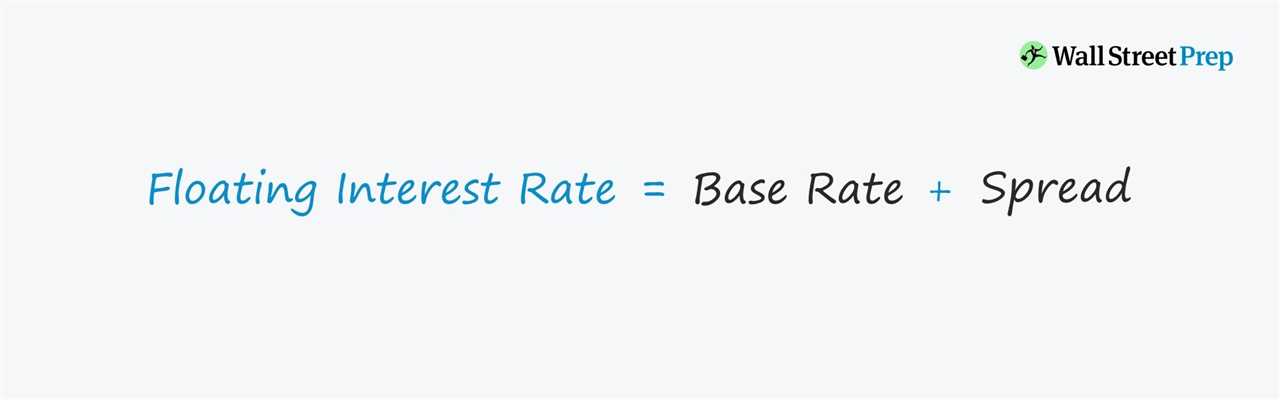

Definition of Floating Interest Rate

Unlike a fixed interest rate, which remains constant throughout the life of a loan or investment, a floating interest rate can change periodically. The frequency of rate adjustments may vary depending on the terms of the loan or investment agreement.

The main advantage of a floating interest rate is that it allows borrowers or investors to take advantage of changes in market conditions. If the benchmark rate decreases, the interest rate on a floating rate loan or investment will also decrease, resulting in lower interest payments. Conversely, if the benchmark rate increases, the interest rate will rise, leading to higher interest payments.

Working Mechanism of Floating Interest Rate

The working mechanism of a floating interest rate is based on the concept of market forces and supply and demand. When the benchmark rate changes, the floating interest rate adjusts accordingly. This means that the interest rate on a loan or investment can increase or decrease over time, depending on the movement of the benchmark rate.

For example, let’s say you have a mortgage with a floating interest rate tied to the prime rate. If the prime rate increases, your mortgage interest rate will also increase, resulting in higher monthly payments. Conversely, if the prime rate decreases, your mortgage interest rate will decrease, leading to lower monthly payments.

The adjustment of the floating interest rate typically occurs at regular intervals, such as every month or every quarter. The specific terms and conditions of the floating interest rate, including the frequency of adjustments and any caps or limits on rate changes, are outlined in the loan or investment agreement.

One of the advantages of a floating interest rate is that it allows borrowers and investors to take advantage of changes in market conditions. If interest rates are expected to decrease in the future, opting for a floating interest rate can potentially result in lower borrowing costs or higher investment returns. However, there is also the risk that interest rates may increase, leading to higher borrowing costs or lower investment returns.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.