What is a 5/1 Hybrid Adjustable-Rate Mortgage?

How does a 5/1 Hybrid ARM work?

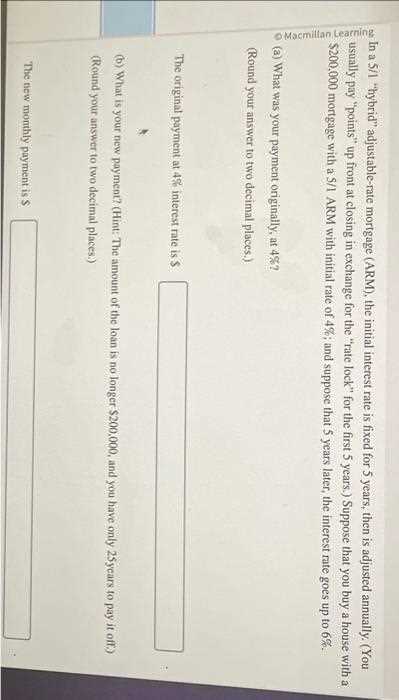

With a 5/1 Hybrid ARM, the initial interest rate is fixed for the first five years of the loan. After the initial fixed-rate period, the interest rate adjusts annually based on a specific index. This means that your monthly mortgage payment may increase or decrease over time.

Benefits of a 5/1 Hybrid ARM

- Lower initial interest rate: The initial interest rate of a 5/1 Hybrid ARM is typically lower than that of a traditional fixed-rate mortgage, which can result in lower monthly payments during the fixed-rate period.

- Flexibility: After the initial fixed-rate period, the interest rate adjusts annually, allowing you to take advantage of potential decreases in interest rates.

- Shorter fixed-rate period: The fixed-rate period of a 5/1 Hybrid ARM is shorter compared to other hybrid ARMs, which means you may be able to take advantage of a lower interest rate sooner.

Considerations for a 5/1 Hybrid ARM

- Interest rate fluctuations: Since the interest rate of a 5/1 Hybrid ARM adjusts annually, your monthly mortgage payment may increase or decrease depending on market conditions.

- Financial stability: Before choosing a 5/1 Hybrid ARM, assess your financial situation and ensure that you have the ability to make higher mortgage payments if the interest rate increases.

What is a 5/1 Hybrid ARM?

A 5/1 Hybrid Adjustable-Rate Mortgage (ARM) is a type of mortgage loan that has a fixed interest rate for the first five years, and then adjusts annually for the remaining term of the loan. This type of mortgage is often referred to as a “hybrid” because it combines elements of both fixed-rate and adjustable-rate mortgages.

The adjustment period for a 5/1 Hybrid ARM is one year, meaning that the interest rate can change once every year after the initial fixed-rate period. The adjustment is typically capped at a certain percentage to protect borrowers from large rate increases. For example, a common cap might be 2% per adjustment period and 5% over the life of the loan.

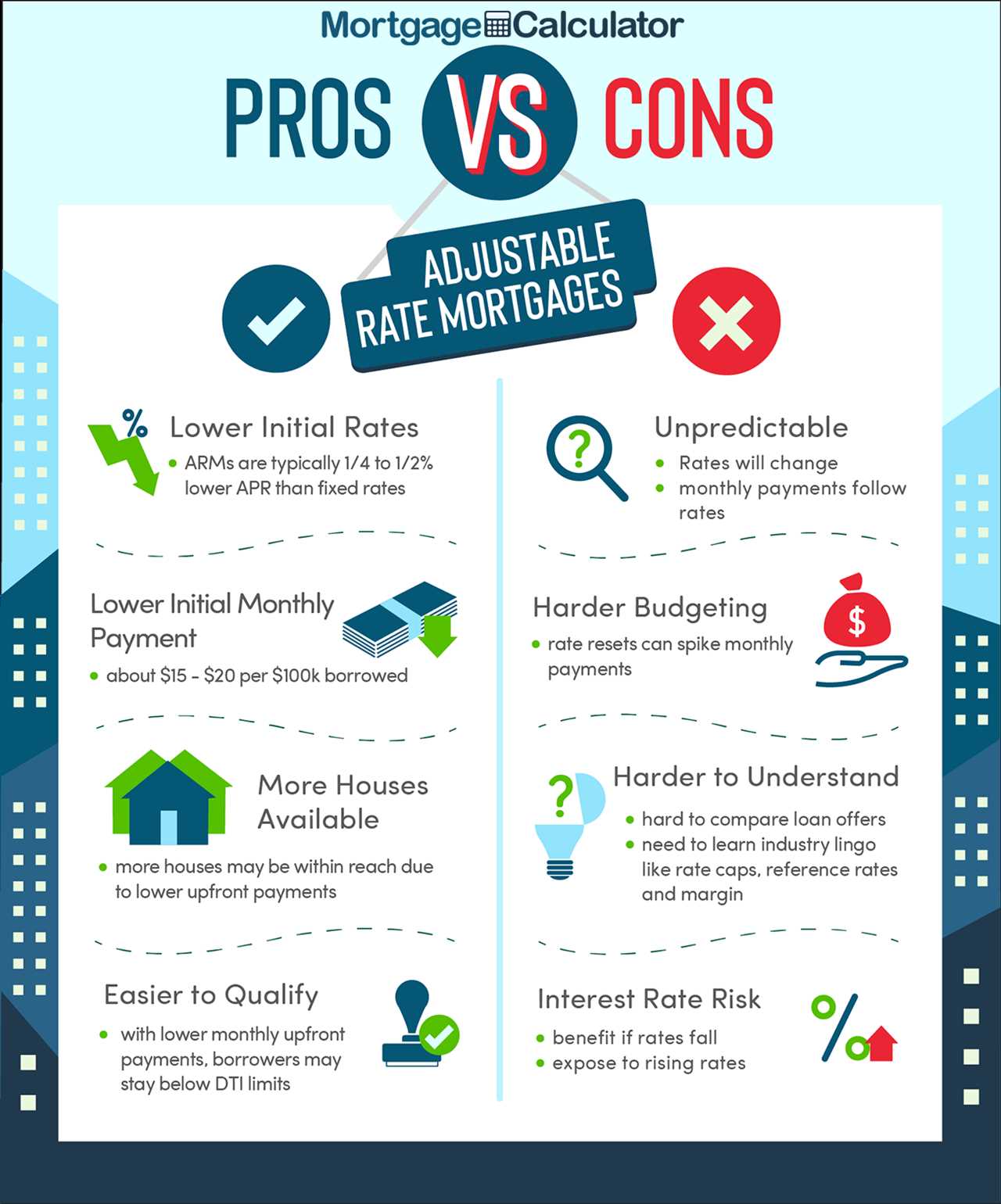

Pros of a 5/1 Hybrid ARM:

- Lower initial interest rate

- Predictable monthly payments during the fixed-rate period

- Potential savings for borrowers who sell or refinance within the first five years

Cons of a 5/1 Hybrid ARM:

- Potential for rate increases after the initial fixed-rate period

- Monthly payments can become more expensive if interest rates rise

- Less predictability compared to a traditional fixed-rate mortgage

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.