What is a Cash Balance Pension Plan?

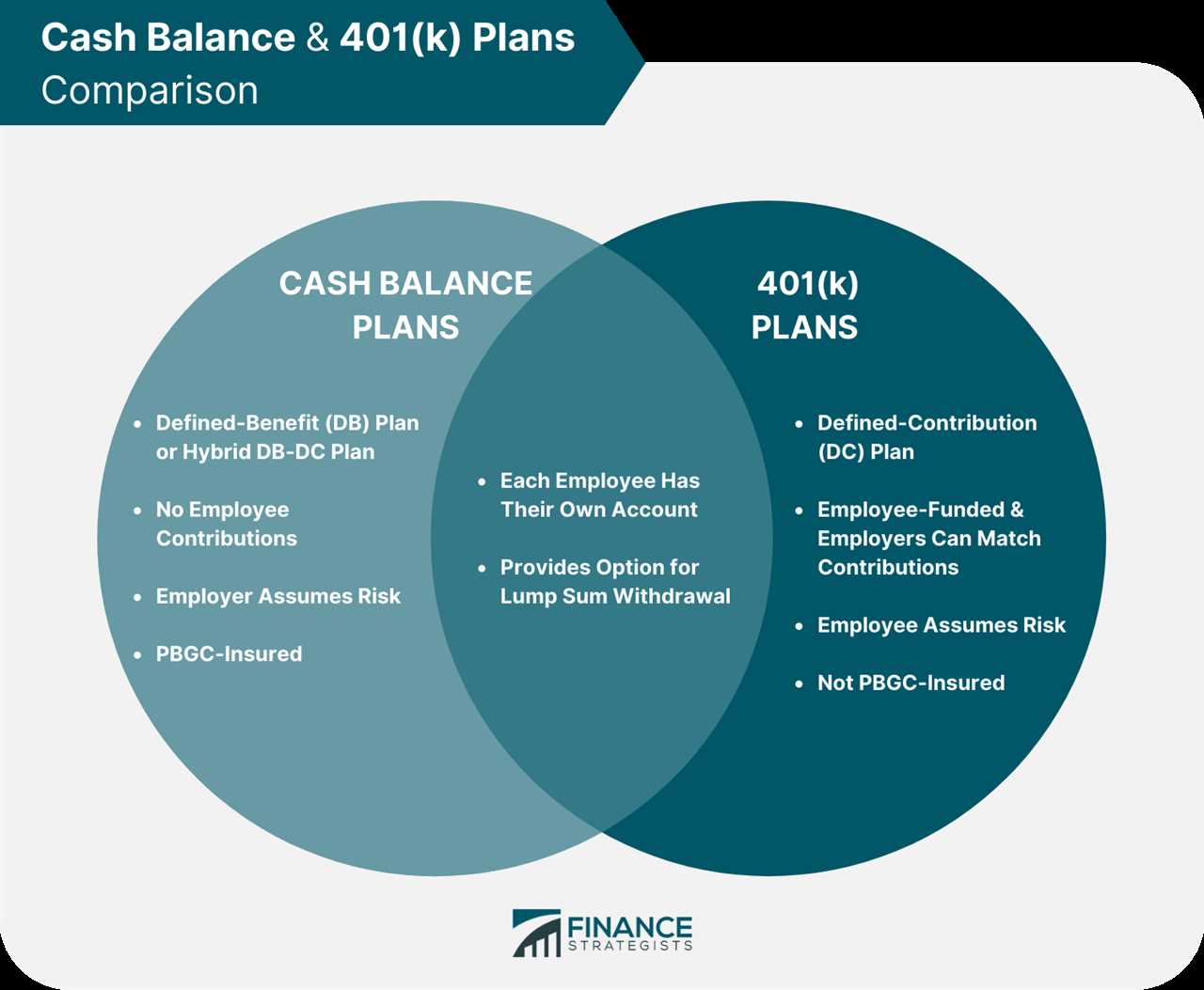

A cash balance pension plan is a type of retirement savings plan that combines features of both traditional defined benefit plans and defined contribution plans. In a cash balance plan, the employer contributes a set percentage of an employee’s salary into an individual account, along with a guaranteed minimum interest rate. The account grows over time, similar to a 401(k) or other defined contribution plan.

Unlike traditional defined benefit plans, which provide a specific monthly benefit based on years of service and final average salary, cash balance plans provide a hypothetical account balance that is used to determine the retirement benefit. This account balance is typically expressed as a lump sum, which can be converted into an annuity or taken as a cash payment upon retirement.

One key feature of cash balance plans is that they offer portability. If an employee leaves the company before reaching retirement age, they can typically roll over their cash balance account into an individual retirement account (IRA) or another qualified retirement plan. This allows employees to take their retirement savings with them when changing jobs.

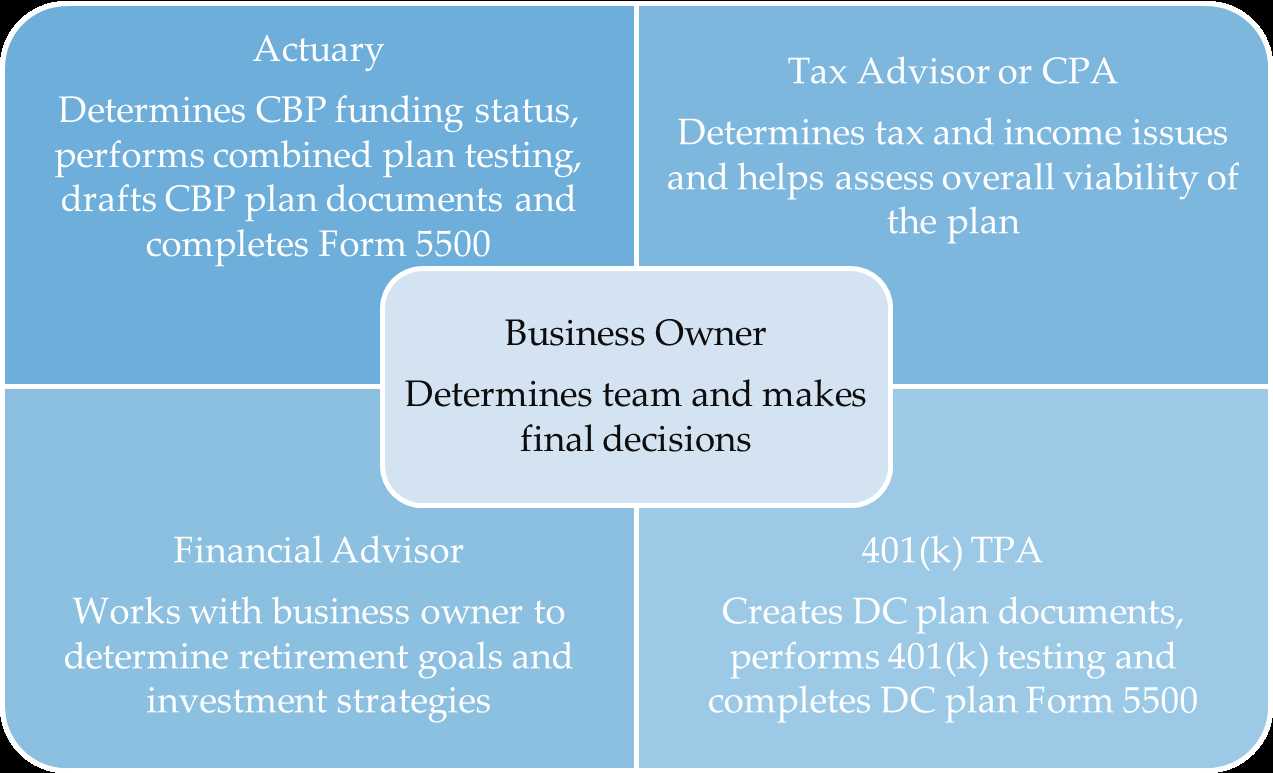

Another important aspect of cash balance plans is that they are subject to certain legal requirements and regulations. Employers must ensure that the plan meets the criteria set forth by the Employee Retirement Income Security Act (ERISA) and other applicable laws. This includes providing regular statements to participants, offering vesting schedules, and adhering to nondiscrimination rules.

In summary, a cash balance pension plan is a retirement savings plan that combines features of defined benefit and defined contribution plans. It provides employees with a hypothetical account balance that grows over time and can be converted into a retirement benefit. These plans offer portability and are subject to legal requirements to protect the interests of participants.

How Does a Cash Balance Pension Plan Work?

A cash balance pension plan is a type of retirement plan that combines features of both a traditional pension plan and a 401(k) plan. It is a defined benefit plan, meaning that the employer guarantees a specific retirement benefit for the employee, but the benefit is based on a hypothetical account balance rather than years of service.

Here’s how a cash balance pension plan works:

1. Contributions:

Both the employer and the employee make contributions to the cash balance pension plan. The employer typically contributes a percentage of the employee’s salary, while the employee may also have the option to make additional voluntary contributions.

2. Hypothetical Account Balance:

Instead of tracking individual investment returns, a cash balance pension plan assigns each participant a hypothetical account balance. This balance grows each year with interest credits, which are typically based on a fixed rate or a percentage of the employee’s salary.

3. Vesting:

Employees become vested in their cash balance pension plan after a certain number of years of service. Once vested, the employee is entitled to the accumulated hypothetical account balance, which can be taken as a lump sum or converted into an annuity at retirement.

4. Portability:

One advantage of cash balance pension plans is that they are more portable than traditional pension plans. If an employee leaves the company before retirement, they can typically roll over their hypothetical account balance into an individual retirement account (IRA) or another employer’s retirement plan.

5. Retirement Benefit:

At retirement, the employee can choose to receive their cash balance pension plan benefit as a lump sum or as a series of monthly payments. The benefit amount is based on the accumulated hypothetical account balance, which has grown over the years with interest credits.

| Advantages | Disadvantages |

|---|---|

| – Provides a guaranteed retirement benefit | – Limited investment options |

| – Portability | – Lower potential investment returns compared to 401(k) plans |

| – Combines features of traditional pension plans and 401(k) plans | – Less flexibility in accessing funds before retirement |

In summary, a cash balance pension plan is a unique retirement plan that offers a guaranteed benefit based on a hypothetical account balance. It combines the features of a traditional pension plan with the portability and flexibility of a 401(k) plan.

Advantages and Disadvantages of Cash Balance Pension Plans

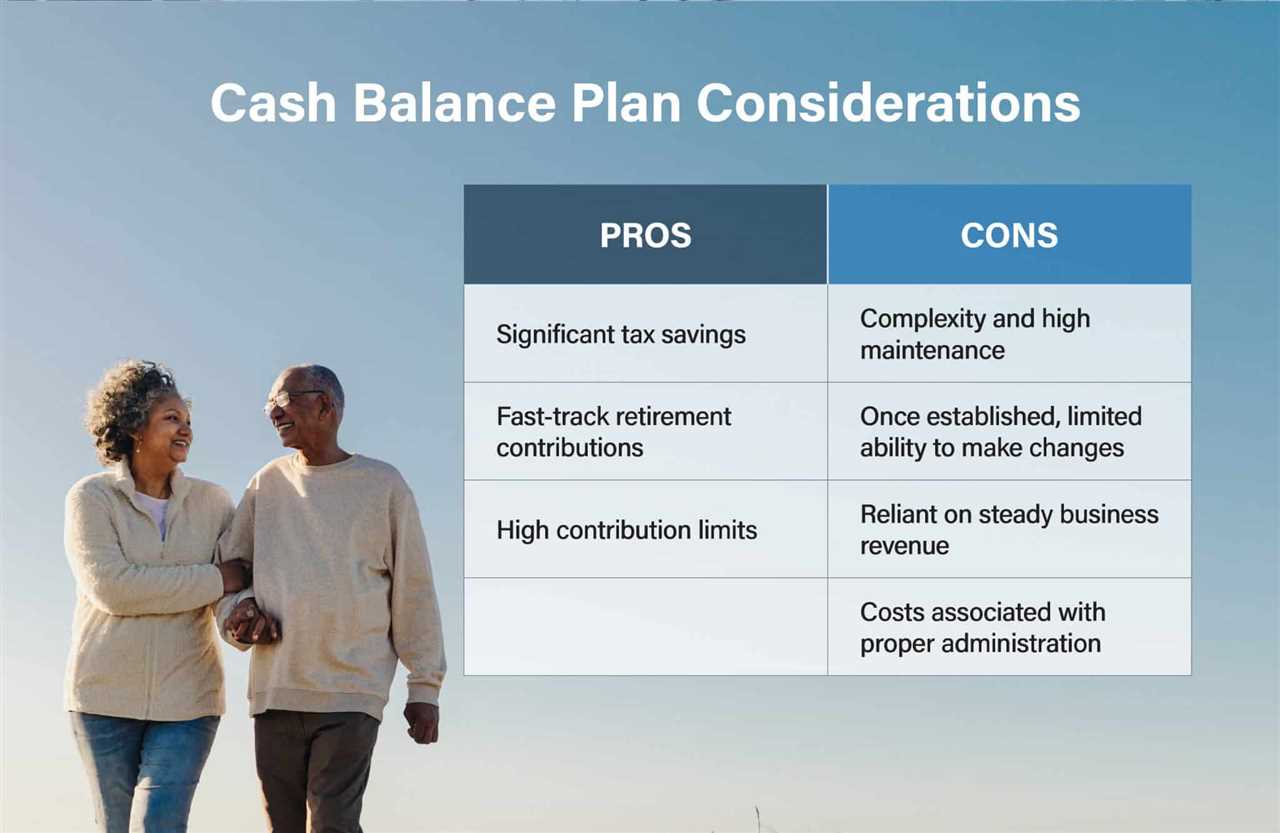

Cash balance pension plans have become increasingly popular in recent years due to their unique features and benefits. However, like any retirement plan, they also have their advantages and disadvantages. It is important to understand these factors before deciding if a cash balance pension plan is right for you.

Advantages

1. Portability: One of the major advantages of cash balance pension plans is their portability. Unlike traditional pension plans, which are tied to a specific employer, cash balance plans are portable and can be transferred to a new employer or rolled over into an individual retirement account (IRA) if you change jobs.

2. Guaranteed Benefits: Cash balance plans offer participants a guaranteed minimum benefit, which provides a level of security and peace of mind. Even if the plan’s investments perform poorly, participants are still entitled to receive their promised benefits.

3. Tax Advantages: Contributions to cash balance pension plans are tax-deductible for employers, and the growth of the plan’s investments is tax-deferred until retirement. This can provide significant tax savings for both employers and employees.

4. Flexibility: Cash balance plans offer more flexibility than traditional pension plans. Participants have the option to choose how their contributions are invested, allowing them to tailor their investment strategy to their individual risk tolerance and financial goals.

Disadvantages

1. Complexity: Cash balance pension plans can be more complex to understand and administer compared to traditional pension plans. The calculations used to determine benefits can be intricate, and the plan may require the assistance of an actuary to ensure compliance with regulatory requirements.

2. Lower Investment Returns: Cash balance plans typically offer a fixed rate of return, which may be lower than the potential returns from other investment options. While this provides stability, it may limit the growth potential of the plan’s investments.

3. Limited Investment Choices: Participants in cash balance plans may have limited investment choices compared to other retirement plans, such as 401(k)s. This can restrict their ability to diversify their investments and potentially earn higher returns.

4. Vesting Periods: Cash balance plans may have longer vesting periods compared to other retirement plans. This means that employees may have to wait a certain number of years before they are fully vested in the plan and entitled to receive their benefits.

Overall, cash balance pension plans can be a valuable retirement savings tool, offering portability, guaranteed benefits, tax advantages, and flexibility. However, they may also be more complex, offer lower investment returns, have limited investment choices, and have longer vesting periods. It is important to carefully consider these factors and consult with a financial advisor before making a decision.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.