Qualifying Relative Definition

A qualifying relative is a person who meets certain criteria set by the IRS. These criteria include:

- Relationship: The person must be related to you in one of the following ways: child, stepchild, foster child, sibling, parent, grandparent, grandchild, aunt, uncle, niece, or nephew. They can also be a descendant of any of these relatives.

- Residency: The person must have lived with you for the entire year as a member of your household, or they can be a close relative who does not live with you but meets certain residency requirements.

- Income: The person’s gross income for the year must be less than the exemption amount set by the IRS. This amount is subject to change each year.

- Support: You must have provided more than half of the person’s total support for the year. This includes financial support for things like housing, food, medical care, and education.

When determining if someone is a qualifying relative for tax purposes, it is important to understand the guidelines set forth by the IRS. These guidelines outline the specific criteria that must be met in order for someone to be considered a qualifying relative.

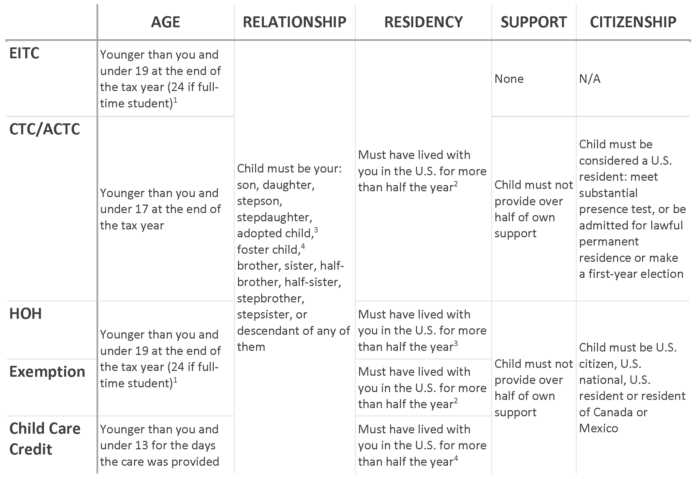

Relationship Test

The first criteria that must be met is the relationship test. According to the IRS, a qualifying relative can be a child, stepchild, sibling, stepsibling, half-sibling, or a descendant of any of these individuals. They can also be a parent, stepparent, grandparent, or any other direct ancestor of the taxpayer.

Support Test

The support test is another important factor in determining if someone is a qualifying relative. This test requires that the taxpayer provide more than half of the individual’s total support for the year. Support includes things like food, housing, clothing, medical care, and other necessary expenses.

Gross Income Test

The gross income test is used to determine if the individual’s gross income exceeds a certain threshold. For the 2021 tax year, the gross income limit is $4,300. If the individual’s gross income is equal to or greater than this amount, they are not considered a qualifying relative.

Joint Return Test

The joint return test states that a person cannot be a qualifying relative if they file a joint tax return with their spouse. This test is important because it prevents married individuals from claiming each other as qualifying relatives.

Citizen or Resident Test

The final test is the citizen or resident test. To be considered a qualifying relative, the individual must be a U.S. citizen, U.S. national, or a resident of the United States, Canada, or Mexico for some part of the year.

| Test | Criteria |

|---|---|

| Relationship Test | Child, stepchild, sibling, stepsibling, half-sibling, descendant, parent, stepparent, grandparent, or any other direct ancestor |

| Support Test | More than half of the individual’s total support for the year |

| Gross Income Test | Gross income less than $4,300 for the 2021 tax year |

| Joint Return Test | Cannot file a joint tax return with their spouse |

| Citizen or Resident Test | U.S. citizen, U.S. national, or a resident of the United States, Canada, or Mexico for some part of the year |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.