What is a Revocable Beneficiary?

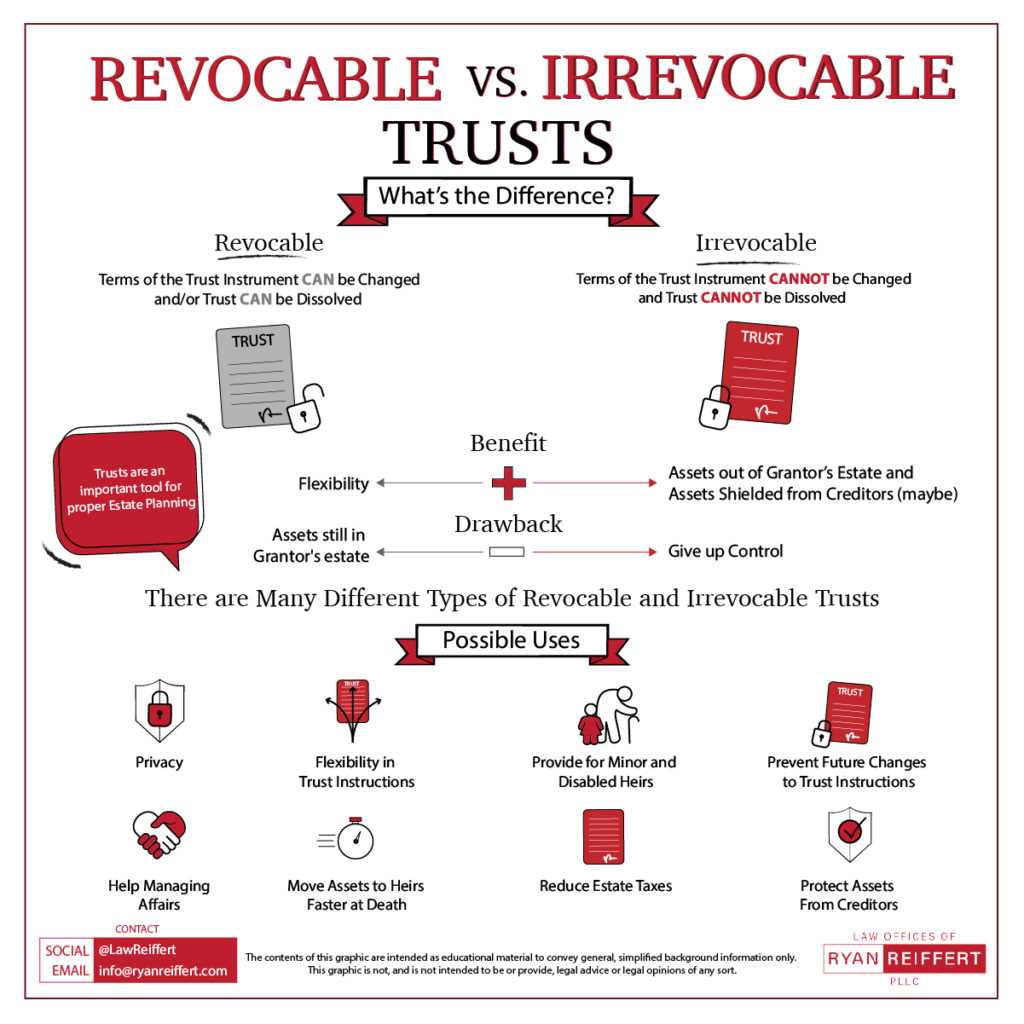

A revocable beneficiary is a term used in estate planning to refer to a beneficiary who can be changed or revoked by the policyholder or account owner at any time. This type of beneficiary designation provides flexibility and control over the distribution of assets upon the policyholder’s or account owner’s death.

When creating an estate plan, individuals often name beneficiaries to receive assets from life insurance policies, retirement accounts, or other financial accounts. Typically, these beneficiary designations are irrevocable, meaning they cannot be changed without the consent of the named beneficiary.

Benefits of a Revocable Beneficiary

There are several benefits to designating a revocable beneficiary in estate planning:

- Flexibility: By having the option to change or revoke the beneficiary designation, individuals can adapt their estate plan to accommodate changes in their family situation, financial circumstances, or personal preferences.

- Privacy: Unlike a will, which becomes a public record upon death, beneficiary designations are typically private. By using a revocable beneficiary, individuals can keep their distribution plans confidential.

- Efficiency: When a policyholder or account owner passes away, assets designated to a revocable beneficiary can be distributed directly to the beneficiary without going through probate. This can save time and costs associated with the probate process.

- Control: By maintaining the ability to change or revoke the beneficiary designation, individuals retain control over who will receive their assets. This can be particularly important in situations where relationships change or new beneficiaries need to be added.

Overall, designating a revocable beneficiary in estate planning provides individuals with flexibility, privacy, efficiency, and control over the distribution of their assets. It is important to regularly review and update beneficiary designations to ensure they align with current wishes and circumstances.

Advantages of a Revocable Beneficiary in Estate Planning

Estate planning is an essential process that allows individuals to ensure their assets are distributed according to their wishes after their passing. One important aspect of estate planning is designating beneficiaries who will receive these assets. A revocable beneficiary is a type of beneficiary that offers several advantages in estate planning.

| Flexibility: | A revocable beneficiary can be changed or revoked at any time during the individual’s lifetime. This provides flexibility in case circumstances change or if the individual wishes to designate a different beneficiary. |

| Privacy: | When assets pass through a revocable beneficiary, they do not go through probate. This means that the distribution of assets remains private and does not become a matter of public record. |

| Control: | |

| Avoidance of Estate Taxes: | Assets that pass through a revocable beneficiary are not subject to estate taxes. This can help reduce the tax burden on the individual’s estate and maximize the amount of assets that are passed on to the designated beneficiaries. |

| Efficiency: | Using a revocable beneficiary in estate planning can help streamline the distribution process. Since assets do not go through probate, the transfer of assets to the beneficiaries can occur more quickly and efficiently. |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.