Different Types of Spreads and How They Impact Trading

There are several types of spreads that traders encounter in the financial markets. Let’s take a closer look at some of the most common ones:

- Variable Spread: Unlike a fixed spread, a variable spread can fluctuate depending on market conditions. It is typically offered by ECN (Electronic Communication Network) brokers and reflects the true market conditions. Variable spreads tend to widen during times of high market volatility and can impact trading costs.

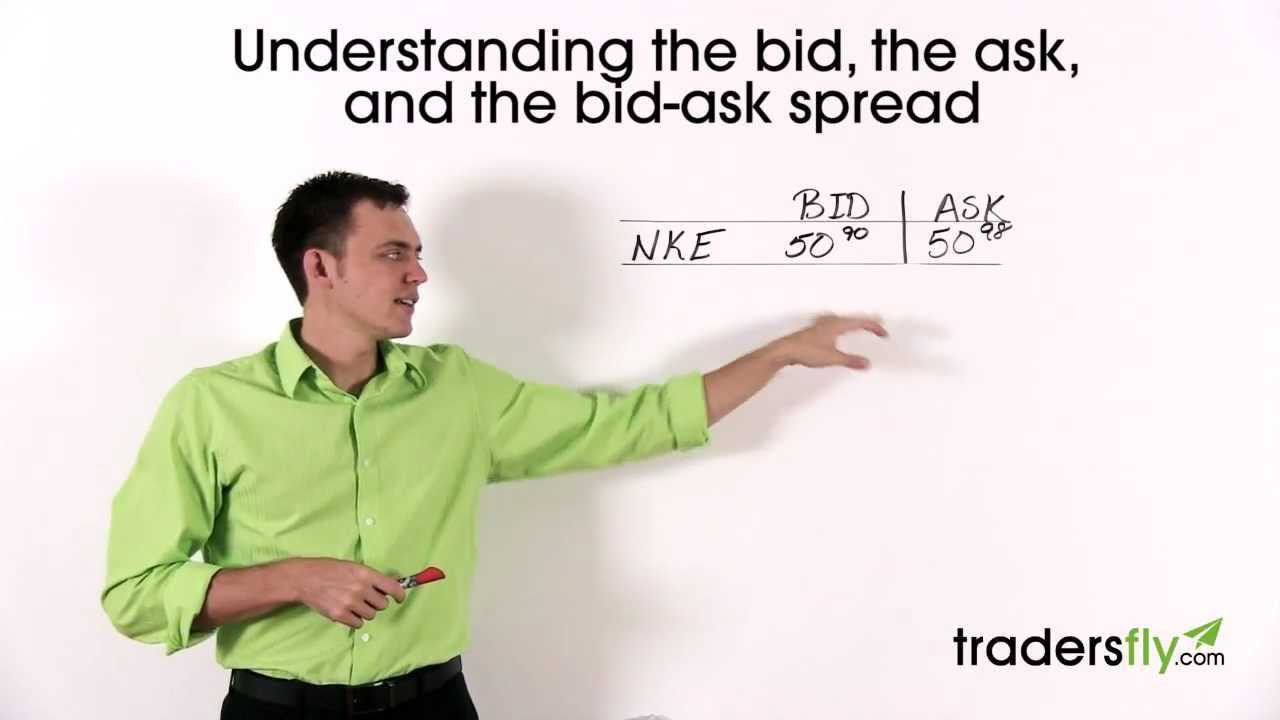

- Wide Spread: In contrast to a tight spread, a wide spread refers to a significant difference between the bid and ask prices. It is often seen in illiquid or less actively traded assets. Wide spreads can increase trading costs and make it more challenging to execute trades at desired prices.

- Commission-Based Spread: Some brokers charge a separate commission fee in addition to the spread. This type of spread is common in ECN trading and is often preferred by professional traders. While the spread may be lower, traders need to consider the commission fee when calculating their overall trading costs.

The type of spread you encounter can have a direct impact on your trading strategy and profitability. It is important to consider the spread when entering and exiting trades, as well as when calculating potential profits or losses. Traders should also be aware of how spreads can vary across different brokers and markets.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.