Definition of the Endowment Effect

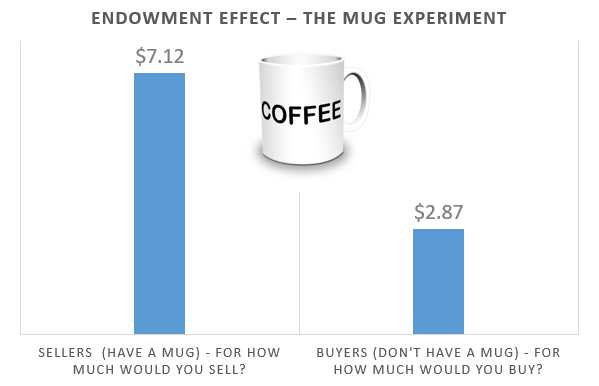

The endowment effect is a cognitive bias that refers to the tendency of individuals to value an item or possession more highly simply because they own it. It is a phenomenon observed in behavioral economics and psychology, which highlights the irrationality of human decision-making.

According to the endowment effect, people ascribe more value to something they possess compared to the same item that they do not own. This means that individuals place a higher subjective value on their possessions, leading to a reluctance to part with them, even when offered a fair price.

Psychological Factors

Several psychological factors contribute to the endowment effect. One of the main factors is loss aversion, which refers to the tendency of individuals to strongly prefer avoiding losses over acquiring gains. When people own an item, they perceive the potential loss of that item as more significant than the potential gain from acquiring it.

Another factor is the status quo bias, which is the preference for things to remain the same. People tend to stick with what they already have because it provides a sense of familiarity and security. This bias influences their valuation of possessions, making them overvalue their current possessions compared to alternative options.

Implications

The endowment effect has important implications for various areas, including economics, marketing, and decision-making. In economics, it challenges the assumption of rationality and highlights the subjective nature of value. It also has implications for pricing strategies, as individuals may be willing to pay more for a product simply because they own it.

From a decision-making perspective, recognizing the endowment effect can help individuals make more informed choices. By being aware of their tendency to overvalue possessions, people can evaluate options more objectively and avoid making irrational decisions based on ownership bias.

Causes of the Endowment Effect

The endowment effect is a cognitive bias that causes individuals to value an object or possession they already own more than the same object or possession that they do not own. This bias can lead to irrational decision-making and can have significant implications in the field of behavioral economics.

Loss Aversion

One of the main causes of the endowment effect is loss aversion. Loss aversion refers to the tendency of individuals to strongly prefer avoiding losses over acquiring gains. In the context of the endowment effect, individuals perceive the loss of an object they already own as a loss, which leads them to overvalue it compared to the same object they do not own.

This can be explained by the fact that people tend to place a higher subjective value on the things they already possess. The fear of losing something they already have creates a sense of attachment and emotional connection, which in turn increases the perceived value of the object.

Status Quo Bias

Another cause of the endowment effect is the status quo bias. The status quo bias refers to the tendency of individuals to prefer the current state of affairs over any change. In the context of the endowment effect, individuals are more likely to value the object they already own because it represents the status quo.

People tend to be resistant to change and prefer to maintain the current state of ownership. This bias can lead to a reluctance to give up the object they already possess, even if it means acquiring a similar or better object.

Ownership and Identity

Ownership and identity also play a role in causing the endowment effect. People often associate their possessions with their identity and sense of self. This association leads to a higher valuation of the object they already own.

When individuals own an object, they feel a sense of control and personal connection to it. This sense of ownership enhances the perceived value of the object and makes it more difficult for individuals to part with it.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.