Introduction

A knock-in option is a type of financial derivative that becomes active only if the underlying asset reaches a certain price level. It is a popular tool used by investors to hedge against market volatility and take advantage of potential price movements.

Types of Knock-In Options

There are two main types of knock-in options:

- Up-and-In Option: This type of knock-in option becomes active if the underlying asset’s price rises above a predetermined barrier level. It allows investors to profit from an upward price movement.

- Down-and-In Option: This type of knock-in option becomes active if the underlying asset’s price falls below a predetermined barrier level. It allows investors to profit from a downward price movement.

Examples of Knock-In Options

Let’s consider a real-life example to better understand knock-in options:

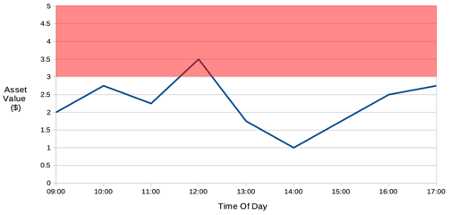

- Scenario: You are an investor who believes that the price of a certain stock will rise in the near future. However, you also want to protect yourself in case the stock price falls below a certain level.

- Solution: You can purchase an up-and-in knock-in option with a barrier level slightly below the current stock price. If the stock price rises above the barrier level, the knock-in option becomes active, allowing you to profit from the price increase. If the stock price does not reach the barrier level, the knock-in option remains inactive.

Similarly, you can use a down-and-in knock-in option if you believe that the stock price will fall below a certain level.

Conclusion

Knock-in options are often used by investors and traders to take advantage of specific market conditions or to hedge against potential price movements. They can be structured as either call options or put options, depending on the desired outcome.

Knock-in options can have different types of barriers, such as up-and-in barriers or down-and-in barriers. An up-and-in barrier means that the stock price needs to rise above a certain level for the option to become active. Conversely, a down-and-in barrier means that the stock price needs to fall below a certain level for the option to become active.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.