Implementation of Kicker Pattern

Step 1: Identify the Kicker Pattern

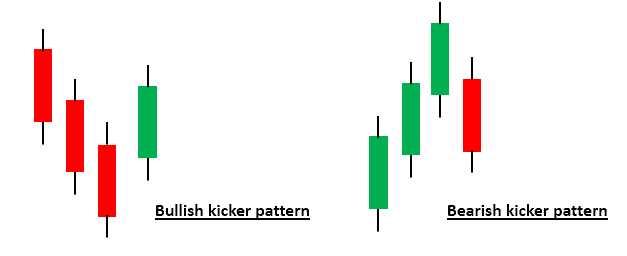

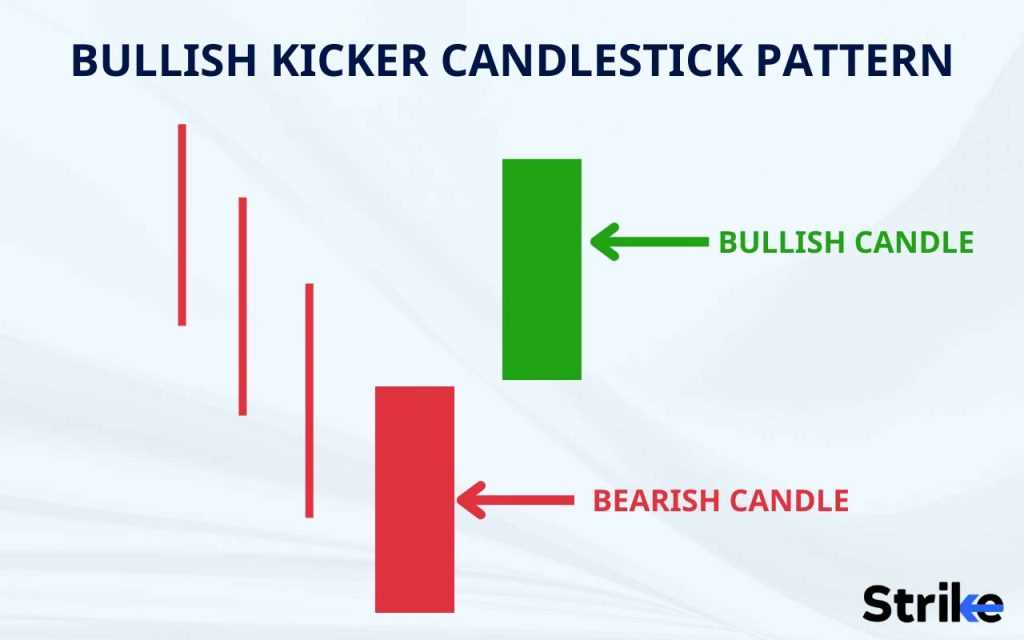

The first step in implementing the Kicker Pattern is to identify it on a price chart. The Kicker Pattern consists of two consecutive candlesticks with opposite colors, indicating a strong reversal in the market. The first candlestick is usually a long and bearish candle, followed by a long and bullish candle in the opposite direction.

Step 2: Confirm the Kicker Pattern

After identifying the Kicker Pattern, it is important to confirm its validity. Traders can use additional technical indicators or analysis techniques to confirm the pattern. This may include trendlines, support and resistance levels, or other chart patterns.

Step 3: Determine Entry and Exit Points

Once the Kicker Pattern is confirmed, traders can determine their entry and exit points. The entry point is typically set at the open of the candlestick following the bullish candle in the pattern. The exit point can be set at a predetermined target level or based on other technical indicators.

It is important to note that risk management should be considered when determining entry and exit points. Traders should set stop-loss orders to limit potential losses if the market moves against their position.

Step 4: Monitor and Manage the Trade

Additionally, it is important to stay updated with relevant news and events that may impact the market. This can help traders make informed decisions and adjust their trading strategy if necessary.

Example of Kicker Pattern Implementation

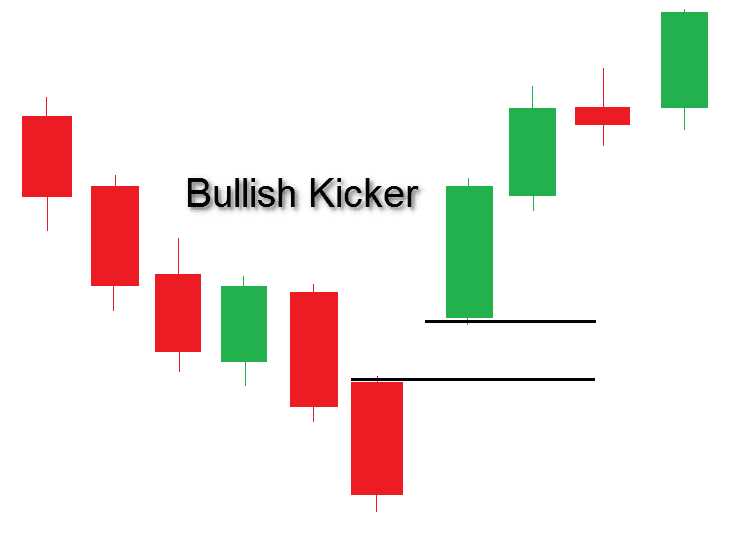

Let’s consider an example to illustrate the implementation of the Kicker Pattern. Suppose we identify a Kicker Pattern on a daily chart of a stock. The first candlestick is a long and bearish candle, indicating a strong downtrend. The second candlestick is a long and bullish candle, suggesting a reversal in the market.

After confirming the pattern and determining our entry and exit points, we decide to enter a long position at the open of the following candlestick. We set our stop-loss order below the low of the bearish candle and our take-profit order at a predetermined target level.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.