Exploring the Mechanism of Gift Causa Mortis in Trust and Estate Planning

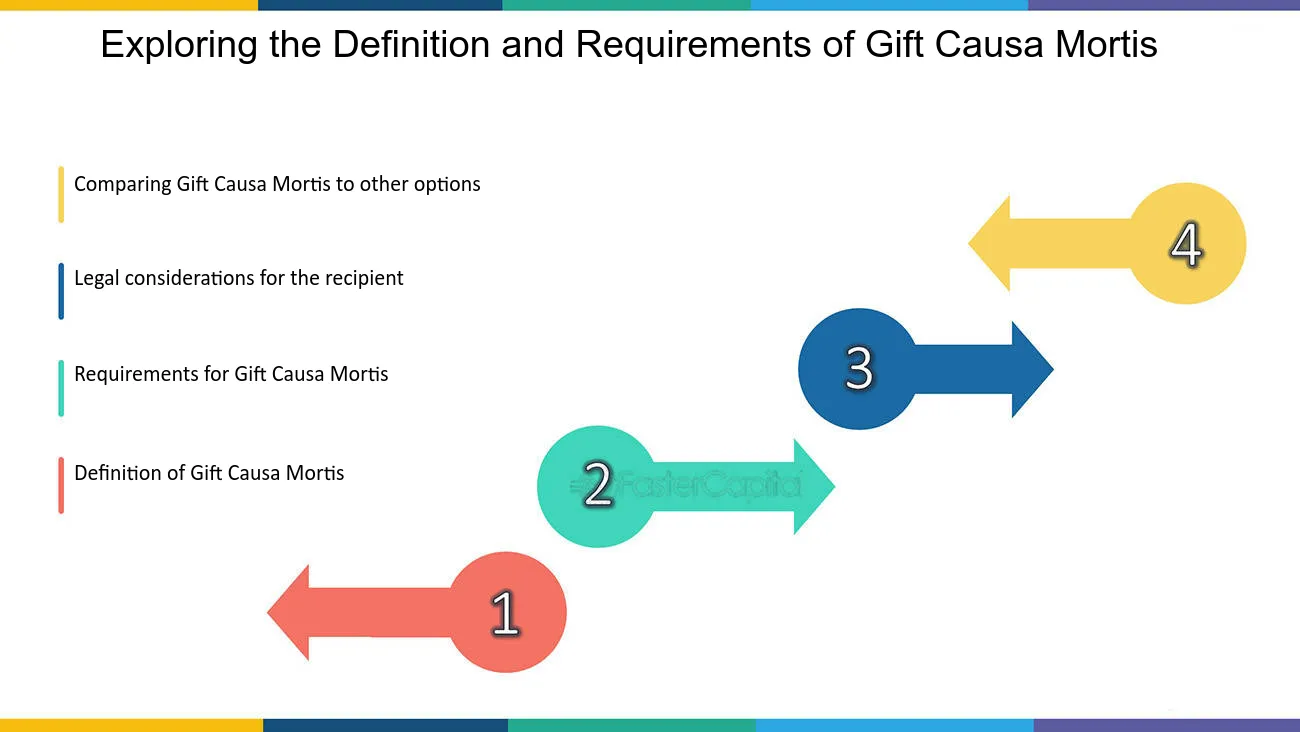

When a person makes a gift causa mortis, they must meet certain requirements for it to be valid. First, the donor must have a present intention to make the gift, meaning they must genuinely want to transfer the property to the recipient. Second, the donor must be in imminent fear of death, such as being seriously ill or facing a life-threatening situation. Finally, the donor must deliver the property to the recipient, either physically or by giving them control over the property.

In the context of trust and estate planning, gift causa mortis can be a useful tool for individuals who want to transfer their assets while still alive but are unsure about the timing of their death. By making a gift causa mortis, they can ensure that their property goes to the intended recipient without going through the probate process.

One of the main advantages of using gift causa mortis in trust and estate planning is that it allows for a more seamless transfer of assets. Unlike a testamentary gift, which is subject to probate and can be challenged by heirs or creditors, a gift causa mortis takes effect immediately upon the donor’s death. This means that the recipient can take possession of the property without any delay or legal complications.

Another benefit of gift causa mortis is that it can help minimize estate taxes. By transferring property before death, the donor can potentially reduce the size of their taxable estate, thereby reducing the amount of estate tax that their heirs will have to pay. However, it is important to consult with a tax professional or estate planning attorney to ensure that the gift is structured in a way that maximizes tax benefits.

It is worth noting that gift causa mortis can be revoked by the donor if they recover from their illness or survive the imminent danger of death. In such cases, the property would revert back to the donor, and any legal documents related to the gift would become null and void. Therefore, it is crucial for individuals considering a gift causa mortis to carefully evaluate their health condition and consult with legal professionals to ensure that their wishes are properly documented.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.