What is an Elective-Deferral Contribution?

An elective-deferral contribution is a type of retirement savings contribution that allows individuals to set aside a portion of their income on a pre-tax basis. This means that the contribution is deducted from the individual’s salary before taxes are calculated, reducing their taxable income for the year.

Elective-deferral contributions are most commonly associated with employer-sponsored retirement plans, such as 401(k) plans. These plans allow employees to contribute a percentage of their salary to their retirement savings account, up to certain limits set by the Internal Revenue Service (IRS).

One of the main advantages of elective-deferral contributions is the potential for tax savings. By contributing to a retirement plan on a pre-tax basis, individuals can lower their taxable income for the year, which may result in a lower tax bill. Additionally, the contributions and any investment earnings grow tax-deferred until they are withdrawn in retirement, allowing the savings to potentially grow more quickly.

Another benefit of elective-deferral contributions is the opportunity for employer matching contributions. Many employers offer a matching contribution as an incentive for employees to save for retirement. This means that for every dollar an employee contributes to their retirement plan, the employer will also contribute a certain percentage, up to a specified limit. This can significantly increase the amount of retirement savings over time.

Elective-deferral contributions are a type of retirement savings plan that allows employees to contribute a portion of their salary to a retirement account on a pre-tax basis. These contributions are deducted from the employee’s paycheck before taxes are calculated, which can provide immediate tax savings.

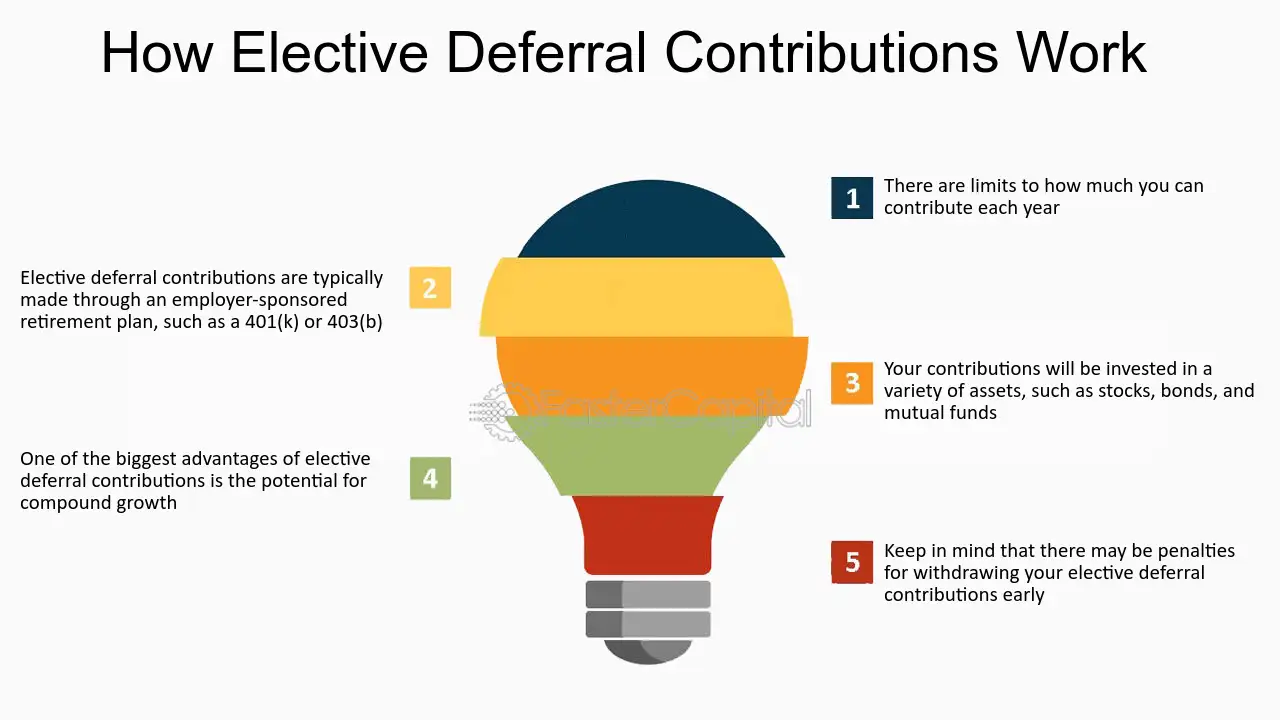

Here are some key points to understand about elective-deferral contributions:

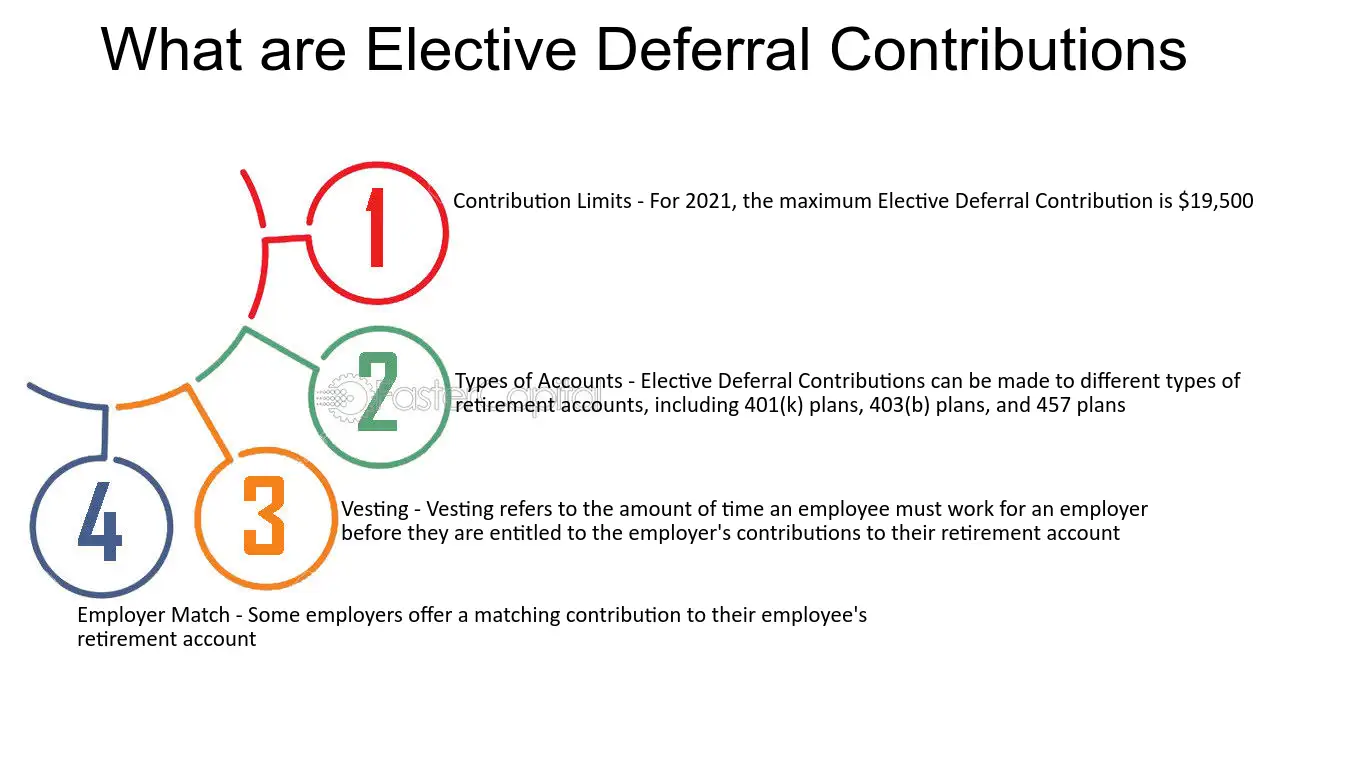

1. Contribution Limits

There are annual limits on the amount of elective-deferral contributions that can be made to a retirement account. For 2021, the limit is $19,500 for individuals under the age of 50. Those who are 50 or older can make additional catch-up contributions of up to $6,500, bringing their total contribution limit to $26,000.

2. Tax Advantages

One of the main benefits of elective-deferral contributions is the tax advantage they offer. Since these contributions are made on a pre-tax basis, they reduce the employee’s taxable income for the year. This can result in lower overall tax liability and potentially allow the employee to save more for retirement.

3. Employer Matching Contributions

Many employers offer matching contributions to employees who make elective-deferral contributions. This means that for every dollar the employee contributes, the employer will also contribute a certain percentage, up to a certain limit. This can significantly boost the employee’s retirement savings and provide an additional incentive to participate in the plan.

4. Vesting Period

5. Investment Options

Elective-deferral contributions are typically invested in a variety of options, such as mutual funds, stocks, bonds, or target-date funds. Employees can choose how their contributions are invested based on their risk tolerance and retirement goals.

Benefits of Elective-Deferral Contributions for Retirement Planning

Elective-deferral contributions are a valuable tool for individuals who are planning for their retirement. These contributions allow individuals to save money for their future while also receiving certain tax benefits. Here are some of the key benefits of elective-deferral contributions:

Tax Advantages

One of the main benefits of elective-deferral contributions is the tax advantage they provide. These contributions are made on a pre-tax basis, which means that the money is deducted from an individual’s paycheck before taxes are calculated. This reduces the individual’s taxable income, resulting in a lower tax liability. The money contributed to a retirement plan grows tax-deferred until it is withdrawn during retirement, allowing it to potentially grow at a faster rate.

Employer Matching Contributions

Many employers offer matching contributions to their employees’ elective-deferral contributions. This means that for every dollar an employee contributes, the employer will also contribute a certain percentage, up to a certain limit. This is essentially free money that is added to the employee’s retirement account, helping it to grow even faster.

Retirement Savings Growth

By making elective-deferral contributions, individuals are able to start saving for retirement at an earlier age. The earlier individuals start saving, the more time their money has to grow and compound. Over time, the contributions and any investment earnings can accumulate and grow into a significant retirement nest egg. This can provide individuals with financial security and peace of mind during their retirement years.

Control Over Investments

Elective-deferral contributions are typically invested in a retirement plan, such as a 401(k) or an Individual Retirement Account (IRA). These plans offer a wide range of investment options, allowing individuals to choose investments that align with their risk tolerance and financial goals. This gives individuals control over how their retirement savings are invested, potentially leading to higher returns.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.