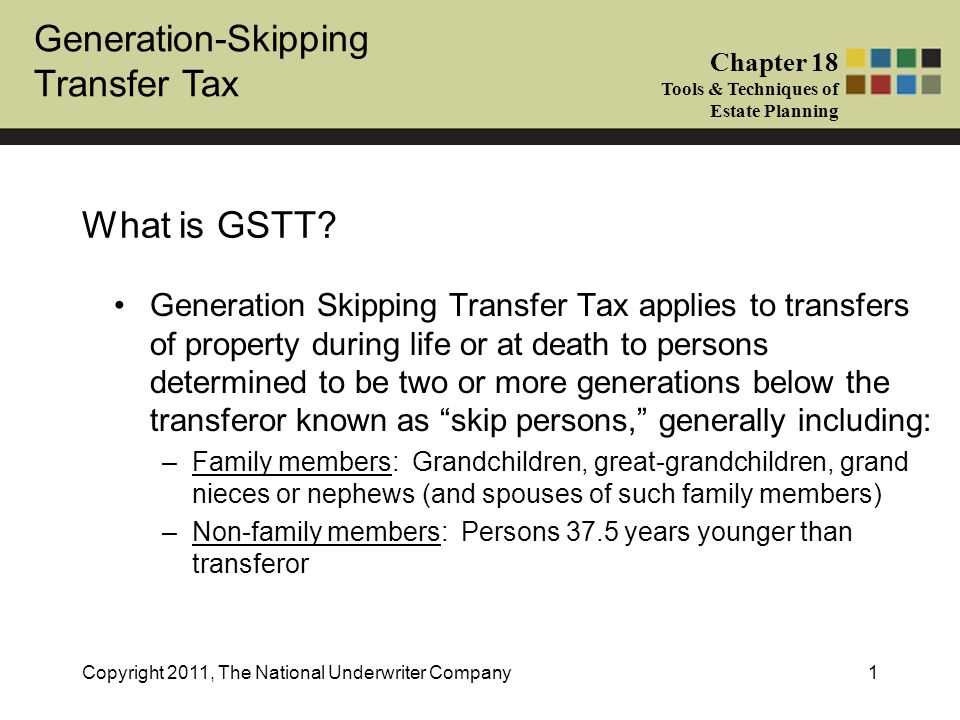

What is the Generation-Skipping Transfer Tax (GSTT)?

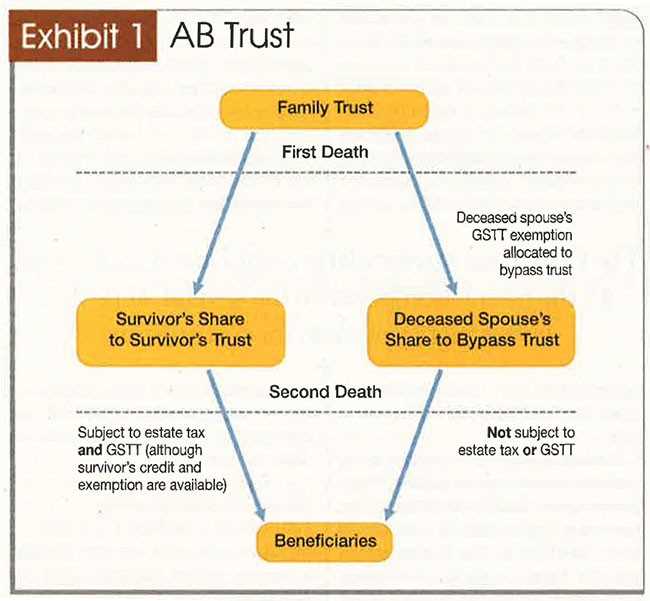

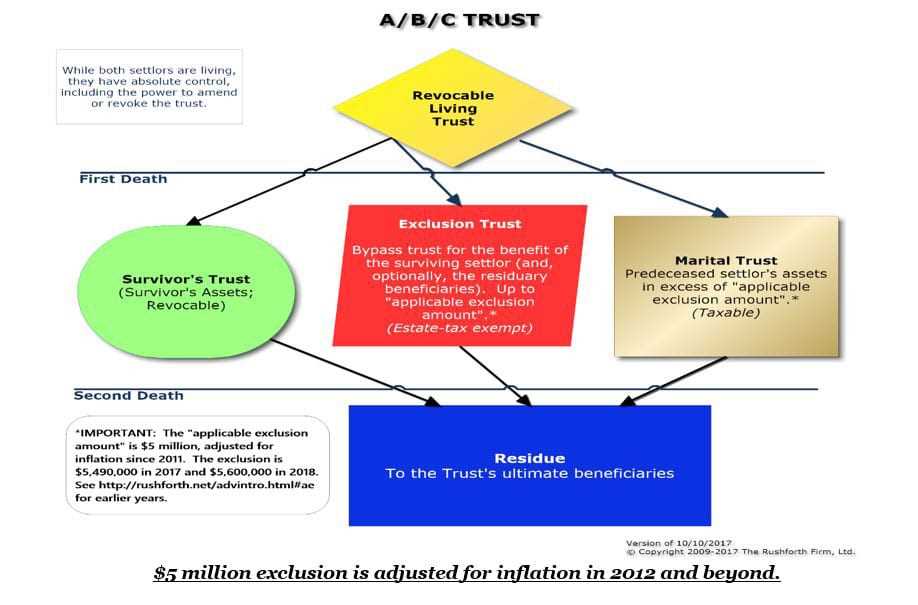

The Generation-Skipping Transfer Tax (GSTT) is a tax imposed by the United States federal government on certain transfers of property that “skip” a generation. This tax is in addition to any other estate or gift taxes that may be applicable.

Who is responsible for paying the GSTT?

The person responsible for paying the GSTT depends on the specific circumstances of the transfer. Generally, the person making the transfer is responsible for paying the tax. However, if the transfer is made through a trust, the trustee may be responsible for paying the tax.

How is the GSTT calculated?

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.